What drives real interest rates? The answer seems to be associated with a demand for precautionary savings. That is, the real rate of interest will be driven by changes in uncertainty and risk aversion. If uncertainty or risk increases, there will be an increase in the demand for safety. if there is a increase in the level risk aversion, there will also be an increase in the demand for safety savings. Past research has shown that the real rates are associated with changes in growth volatility, but another recent paper called “Precautionary Savings in Stocks and Bonds” looks more closely at measures of volatility and changing risk aversion or attitudes to risk in the stock market which can be useful at linking change in real rates to market behavior.

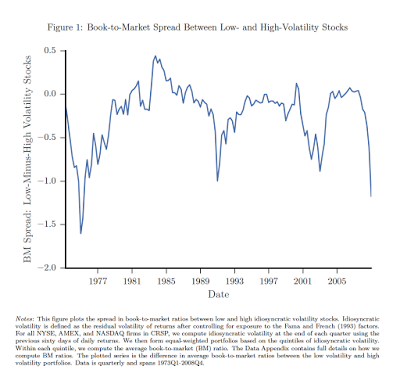

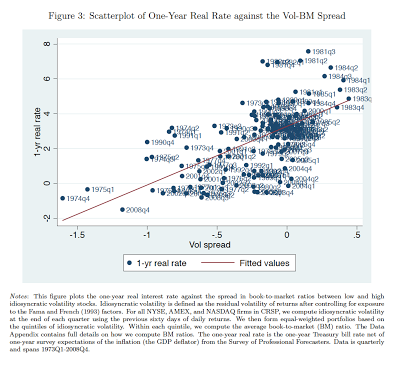

The authors look at a novel measure of market uncertainty that will drive precautionary savings, the difference in valuation between low and high volatility stocks. Now, this is not a measure that will naturally jump in the minds of most investors. I would be interested in the author’s “data-mining” techniques for stumbling on this measure, but this measure does exist and is informative. Look at the valuation differences between high and low risk stocks. It does make some intuitive sense as a measure of cash flow growth and risk.

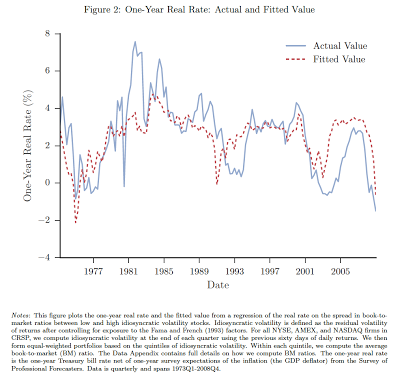

What is interesting is that when this measure of risk is included with more traditional measures of valuation and growth, the volatility measure is statistically significant and meaningful as a measure of demand for precautionary savings.

The importance of thinking about risk and precautionary savings is that a meaningful portion of rate movements is not related to growth but to risk aversion and volatility. If we get a jump in risk aversion, rates will go down and if there is less risk aversion, then downward rate pressure will be gone and rates will rise. Yet, the rate rise will not immediately mean a decline in the stock market. The correlation link between stock and bonds may not exist going forward.