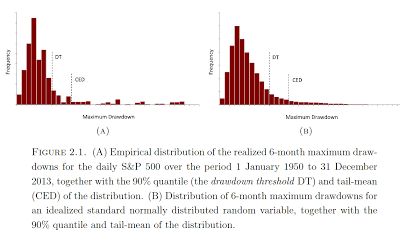

While there is a strong interest in short-term return performance and volatility of hedge funds, drawdown is still the risk where most investors have placed their focus. Maximum drawdown, as a risk measure, can be formalized as the conditional expected drawdown or the measure of the tail mean of a maximum drawdown distribution. The figure below shows what that distribution will look like. What makes this risk measure especially useful is that it can be employed in any optimization and has a linear attribution to factors. Maximum drawdown can have traded off against return or specific risk factors. It can be compared or related to the marginal contribution of risk measure which has gained popularity with many investors.

Perhaps more important, drawdowns are serially correlated with the return pattern of a manager. This means that if the returns of the manager show serial correlation, it will show-up in the drawdown data as more significant drawdowns. The drawdown of a portfolio will be related to the correlation across managers. See “Drawdown: From practice to theory and back again” by Lisa Goldberg and Ola Mahmoud.

Drawdowns are path dependent. How the returns of the manager evolve over time is relevant. It is notable that volatility and expected shortfall do not capture the impact of small cumulative loses like a drawdown measure. In this case, the path dependency within drawdowns provides useful information on risk.

Drawdown has been used as a descriptive measure of risk, but more formal analysis suggests that it would be a good measure to optimize against other factors. It may be more useful than expected shortfall or volatility to help minimize the worse case scenarios faced by investors.