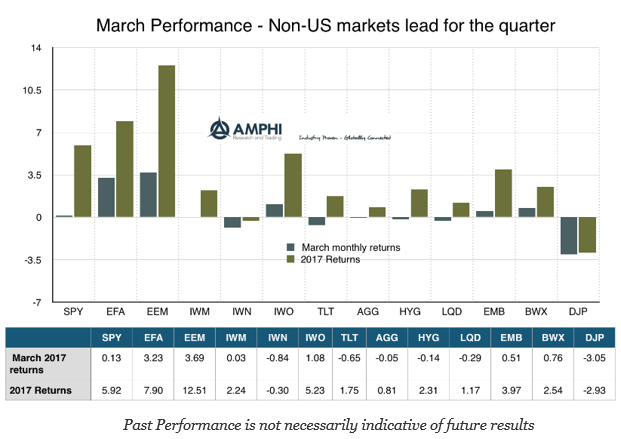

The capital flows and returns for the month and quarter tell a risk-on story for global markets. This is not the case for the US where equity returns were at best flat and bonds showed negative returns in March. The dollar sold off for the month by slightly less than one percent as measured by the DXY dollar index. Even if we account for the dollar tailwind for international stocks, global equities did better than the US by well over 2% for March. Emerging markets have seen the best quarter in years with double-digit returns. Adjusting for the dollar would have placed international and emerging market bonds in-line with US bond returns.

We are a long way from the threat of a global slowdown based on trade wars. Similarly, we are a long way from the early Trump rally in US equities driven by bold tax reform and fiscal stimulus programs. All tax reforms have always taken longer than expected and there is no special magic with the current Trump administration at moving an agenda. Similarly, we have seen the problems with moving “shovel-ready” projects through Congress. Spending programs such as infrastructure development take time to move through the legislative process. Hence, the euphoric sentiment in US stocks has been tempered and the value for non-US markets has taken on new life with the higher expectations for global growth.

Fixed income has fallen in-line with a higher global growth story, stronger inflation numbers, and a Fed that is tightening faster than expected earlier in the quarter. The numbers tell us that we are close to optimal targeting for unemployment and inflation. Inflation itself, as measured by the latest PCE inflation index numbers, is closing in or around 2% but does not seem to be in an overshoot mode. Hence, bonds have not seen a large sell-off in March and still showed positive returns for the quarter. The outlier on the downside has been commodities which sold-off in many key markets.