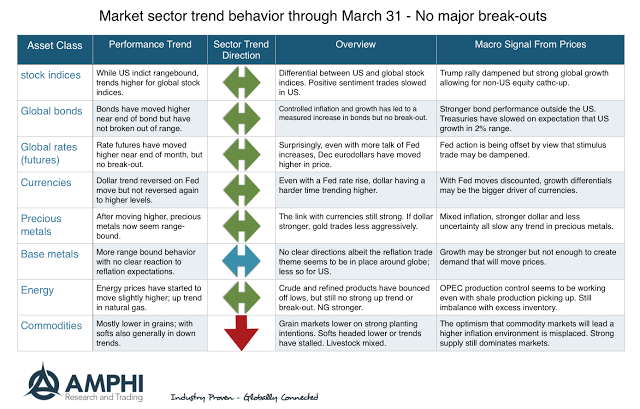

For most managed futures managers, the modeling task is simple, look for trends or break-outs. Managers are not predictive but reactive to what market prices are doing. Looking at the current price data across the major sectors provide little evidence of strong trends or break-outs. Trends that seem to be currently developing are not strong enough to move beyond recent highs, so our trend sector matrix is showing sideways to a slight up moves across most sectors with the only strong trends in commodity markets.

These sideways indications do not mean that there won’t be strong trends in April. It just says that trends at the end of the month were limited and any extrapolation will suggest limited returns. There were a number of strong trend reversals upon the FOMC announcement of a rate hike in mid-March. This central bank action and commentary arrested moves in currencies, fixed income, and rates especially within the US. The best trends may be in non-US global stock indices and fixed income.

The signals from price tells us the positive sentiment trades for Trump policies are being reassessed with non-US markets moving to a growth reflation story albeit one that is still modest by comparisons with the past. Generally, the markets have lost a clear direction from the macroeconomic environment. Commodity signals tell us that supply imbalances still exist and the work-off of inventories will take some time as long there are no surprise demand shocks.

We may be surprised later in the month, but April returns currently will have limited tailwinds from March trends that could drive managed futures performance.