Another simple test to determine whether managed futures returns will do better than average is by looking at economic growth. We know that bonds and other defensive assets like managed futures will do better in “bad times,” such as a recession, but there are not many recessions. The cost of being defensive can be very high if you have to pay for downside protection through explicit insurance or holding assets with a lower expected return.

The alternative is to think a little more broadly about the definition of “bad times.” The deviations for growth or growth recessions are also periods when defensive assets should do better. If there is a slowdown in economic growth, firms and market prices will adjust. Price discounting will occur when growth slows. Inventories will build during growth slowdowns. As a result, investors will be more cautious.

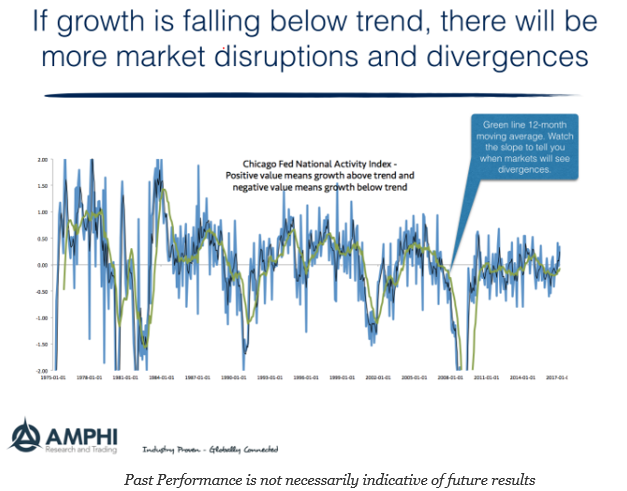

A more straightforward test for defensive assets is to look at the deviations from trend growth. The Chicago Fed National Activity Index is a simple index of deviations from trend growth that incorporates a significant amount of economic information. If the index is negative, then the economic activity is below trend. Conversely, positive values suggest economic activity is above trend. The switches between above and below-trend growth are evident; these transitions offer opportunity.

Noticeably, there has been little deviation from the trend since the Great Financial Crisis. The current period may better represent the Great Moderation than the mid-1990s. The difference is that the deviations seem to be closer to the trend. This means that we have exceptional growth in the current environment but only growth closer to the trend. We show in green the 12-month rolling average value.

This research on “bad times” is ongoing, but we have found that returns for managed futures are slightly higher during periods of declining or negative deviations from the trend. This mean difference has a p-value of .2 for a one-tailed test, suggesting a weak difference. Our analysis shows that performance for managed futures is higher than normal when there is a deterioration of financial condition versus periods of slower economic growth. Our ongoing research examines the impact of “growth recessions” on other hedge fund strategies.

The crisis alpha that may exist in managed futures shows stronger performance during market downturns, but more importantly, managed futures performance is tied to changes in economic performance. Deterioration of financial conditions or growth, the harbinger of a possible asset price crisis, are the more primal cause of excess returns.