What has been at the vanguard of thinking in finance is the breakdown of returns into their constituent parts or risk factors. Finance has moved well beyond market beta. The first breakdown for a portfolio is not returns by asset class but returns by risk factors. Some have criticized the current situation as a factor zoo; however, even factor excesses do not change the fact that factorization is the paradigm used more and more by investors.

There are many factors and many assets to map with factor weighting. The sheer size of the problem lends itself to computerization and data mining. The analyst’s role as a storyteller is diminished when a stock can be described through a set of modeled factors. Investors now buy risk premia, not stories or names. Individual names are just the means to the end of gathering beta risks. Smart beta is just the realization that if factors can describe stocks, they can also be used to weight stock portfolios. This may be smart or just the outgrowth of how the finance world is viewed.

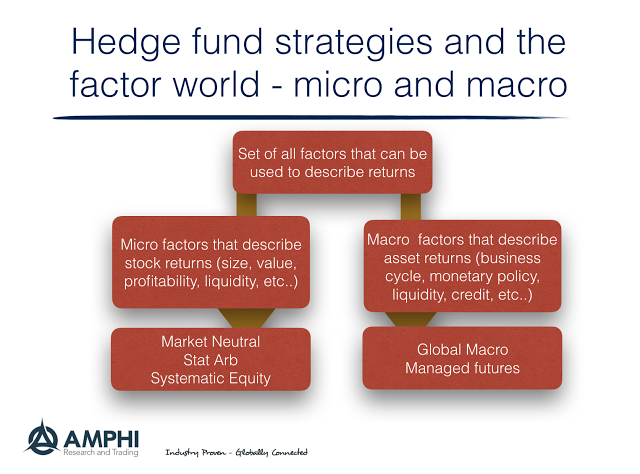

Micro vs. Macro Factors

Factors can be classified into two main categories: micro factors, which are asset-specific and macro factors which are related to macro events like the business cycle or changes in rates and credit availability. Hence, the type of hedge funds chosen by investors is based on whether the manager focuses on micro or macro factors.

Global Macro Investing

So what is the essence or purpose of global macro? In this new factor worldview, global macro investing focuses on broad economic factors that can be dynamically adjusted to generate excess return. Since elements move in and out of style or importance, the macro investor tries to find ways to exploit these changing weights.

The issue is which factors are relevant for global macro investing. We know the criticism of factor timing, so we must be precise about what factors we discuss. Global macro has the overarching theme that the manager is trying to identify international business cycles or growth recessions that spill over to the behavior of specific asset classes. Along with the business, credit and financial cycles impact asset classes around the globe differently. In addition, the growth/inflation mix affects policy choice, which feeds back on asset classes. What makes global macro so tricky is the low predictive skill of managers at forecasting these macro factors.

The difficulty with forecasting macro factors calls for managers to stay diversified, follow market trends, and take high probability tilts to specific factor opportunities. The poor performance for global macro is a function of the increased uncertainty associated with the significant macro factors. There is no smart beta in global macro if the macro factor directions cannot be identified. Global macro returns will only improve if the degree of uncertainty concerning growth, inflation, and liquidity falls to levels that allow bets to be identified and managed.

Managed Futures Programs

The better performance with managed futures programs is based on the core focus on momentum and diversification. Unlike global macro, managed futures capture macro events through asset price movement. Therefore, they do not rely on fundamental macro factors, which are difficult to forecast accurately. Instead, they follow trends and make trades based on the momentum of asset prices. This strategy has proven more effective than global macro, as it can offer better performance, especially in times of high uncertainty.

Therefore, while global macro can be a valuable strategy, its success depends on accurately identifying and managing macro factors. Managed futures programs, on the other hand, offer better performance due to their focus on momentum and diversification. Moreover, by following market trends and making trades based on asset price movement, managed futures programs can offer higher returns, even in times of high uncertainty.