There are many narratives for why equities or bonds will move higher, but a recurring theme is the financial conditions faced by investors. Financial conditions provide the tailwinds or headwinds to push asset class returns. These conditions tell us something about whether we will be transitioning between a risk-on and risk-off environment or whether we will be a crisis mode.

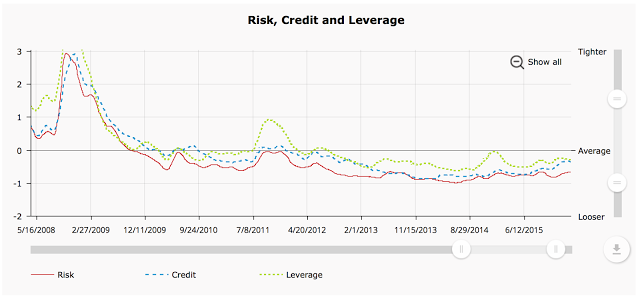

An ongoing research project is tying financial conditions to asset class and hedge fund returns. Our core hypothesis is that trends or transitions in financial conditions will drive trends in financial returns. When condition move from loose to tight, there will be a switch from risk-on to risk off. The Great Financial Crisis was an obvious transition in financial conditions. The second half of 2011 was another transition period which was, to a degree, averted by the Fed’s Operation Twist. More recently, the second half of 2014 was affected by the tightening of leverage.

Currently, credit conditions are starting to tighten, albeit slowly, although credit, credit, and risk are still on the loose side; consequently, there is little reason to see a change in the current risk-on sentiment and behavior in markets. Nevertheless, trends in financial conditions will impact trends in financial assets.