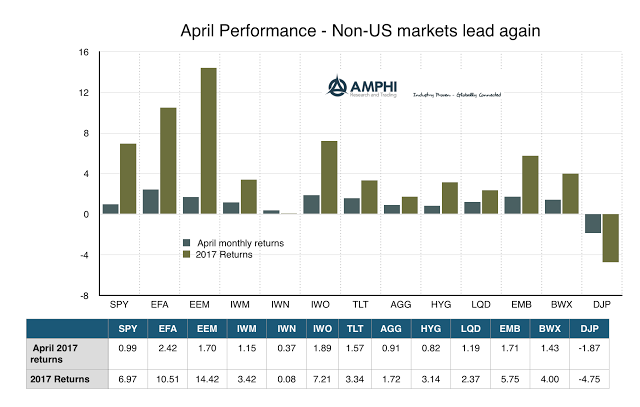

It is a risk-on world with global equities (EFA) and emerging markets (EEM) now posting double digit gains for the year. A first round French election that was pointed less in the direction of Le Pen and a Trump presidency that does not seem as extreme as some pundits suggested has been coupled with global economic growth that is stronger than expected. The deflation trade may be further tempered in the US, but the threat of trade wars has diminished and the world economy is more focused on reality than dire economic scenarios.

While there are some warning signs of slow growth in the US, the US and global economic environment continued to be a “Goldilocks”, not too fast and not too slow. Financial conditions are still loose even with a Fed that has continued their pace of tightening.

Safe assets in fixed income are also positive for the year given that inflation does not seem to want to overshoot and there has not been economic growth to take rates out of their range. The only negative assets class was commodities which fell on a reversal of oil prices.

In a risk-on environment, strategies that offer investor protection will lag the overall market. Higher beta strategies will do well, and talk of diversification will be thrown aside. Of course, the risk-on trend will pass. It always has. If we are Minsky follower, we know that the seeds of future instability are being planted in the calm of today.