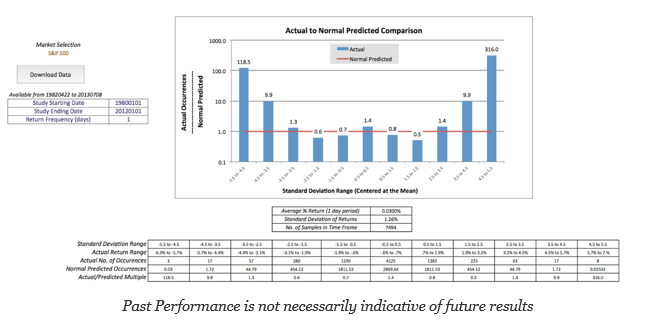

I was reviewing an interesting research piece from Covenant Capital on kurtosis across different assets traded in the futures markets. They offer a spreadsheet tool that can allow anyone to find the number of fat-tailed occurrences relative to a normal distribution. The data show that there are fat-tails everywhere across all asset classes. We do not live in a normal distribution world. This should not be a surprise to most investors, but the important question is how do you effectively function in this non-normal world? Or, more precisely, how do you profit from this knowledge.

We have been strong believers in the concept of investment strategies falling into two categories based on market convergence and divergence. Some investment strategies are better able to exploit the fact that the world is non-normal because they will perform better during extremes regardless of time horizon.

If you live in a non-normal world, you will have to find strategies that will do well if there is a tail event. Nassim Taleb will say that you have to have some “anti-fragile” systems. You could just buy straddles to take advantage of the wings but you pay a premium while you wait for these divergent events. Another alternative is to invest in strategies that can exploit large divergences. The simplest of these could be trend-following.

Inherent in these divergent strategies are their success based on dislocations. If there is a trend that takes you to a positive extreme, the trend follower will buy and hold as long as that market continues to move in the same direction. There is no discussion on whether this is possible or not based on the fundamentals. There is no second-guessing. The strategies will make more money the further a market moves away from the norm. Given there is no view on normality, the strategy will do better when there are more extreme events. This strategy is “anti-fragile”.

There implications of non-normality go beyond just looking at strategies. Risk management based on normality is a loser’s game. The investor will expect limited tail events that will actually occur more frequently and will be bigger than expected. The market has been moving to more sophisticated approaches to tail risk but these are still the exception and not the norm. Investment reward and risk are in the tails if you look closely.