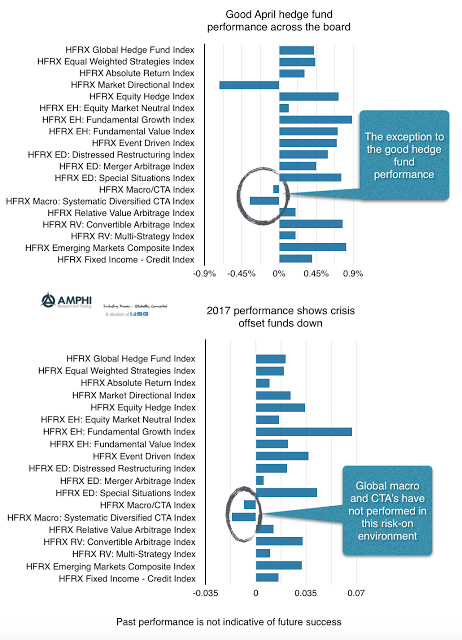

No hedge fund strategy will make money all of the time. As the market and economic environment changes, the performance of different strategies will also change. Hedge fund factor exposures will be different based on the strategy employed by the manager. If you cannot predict the environment factor exposures, there is value with holding a diversified portfolio of hedge funds. April performance clearly shows the difference in strategy behavior.

We are in a risk-on environment. Hence, those strategies that do well in “bad times” or risk-off regimes will underperform other hedge fund strategies. We should not be surprised by the current macro/systematic/CTA performance. We may not like it, but it is within some tolerance of expectations.

Given the average beta for many equity hedge fund strategies, performance is within expectations. Long-only hedge positioning should do better in a reflation environment. We may expect better alpha generation; however, the low volatility regime may limit the set of opportunities for stock-picking or relative value trades.