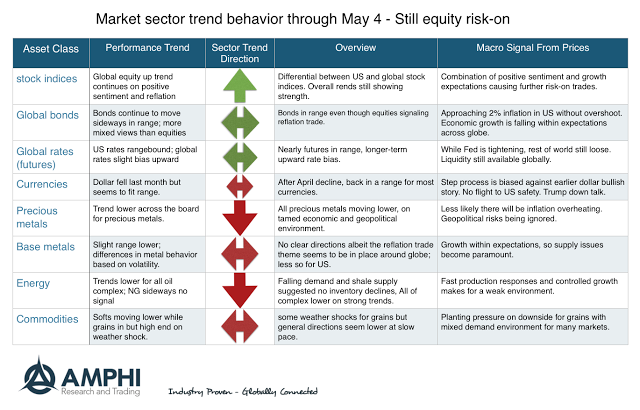

Going into the month, there are good up trends in place with global equities and down trends in oil, precious metals, and selected commodities. What is interesting is the inconsistency across some markets sectors. The reflation risk-on trade is still apparent in the global equity indices, but we are not seeing strong evidence of bond sell-off or rally. Oil prices suggest both supply strength and demand weakness. Gold and precious metals are out of favor with long-only investors. The idea that we will have a dollar rally on Fed hikes seems misplaced and there is less risk-on demand for the US relative to the rest of the world.

Generally, we find sector indicators to suggest a more opportunity rich environment for trend-followers especially for those who have a greater tilt to energy, metals, and commodities. Nevertheless, history has proved in the past that performance in managed futures will usually be especially strong if there are well-established bond trends.