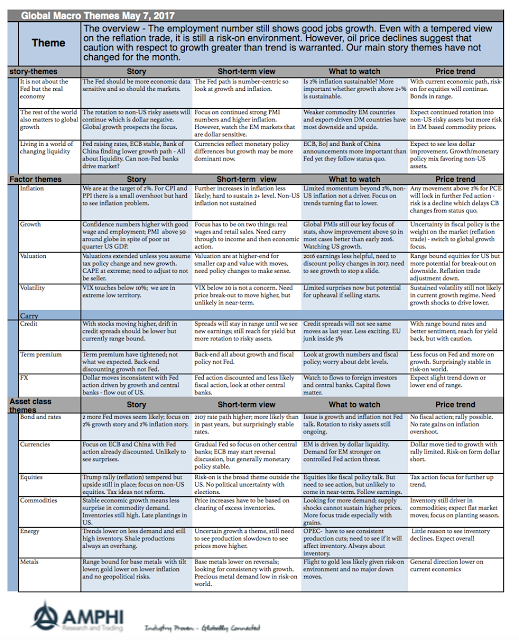

The Fed and other central banks are not that important in the current thinking of investors. The focus is not on the policy musings of bankers but the real economic data. All that matters is whether growth has a strong chance to be above trend and whether global DM inflation has a chance of reaching and sustaining 2%. We are skeptics of both occurring.

A strong growth trend will allow the current risk-on environment to continue. Inflation moving higher will reinforce more conservative or hawkish central banker views. The euphoria toward the reflation trade is coming back to reality and is likely to move more closely to the real data. Growth may be stronger than last year but break-out trends in growth are unlikely even with strong PMI’s signals. Bond investors have stayed cautious about this risk-on world and falling oil prices signal weaker demand.

There is a disconnect between equity and bond market views of the world. We do not intend to fight the risk-on sentiment and side with the more conservative bond view, but any risk-on overweight is modest in the current environment.