Managed futures research is hard. This is especially the case in the quantitative area. There always are new models being tested by almost all managers, but finding a truly new model or process that adds value is truly difficult. Data mining is an issue.

Managers gain new data everyday but most of the test data has existed for years. This past data are not changing and has been mined extensively. Many of the techniques used to extract signals are well known. The objective functions or goals for most programs and investors are well known. Most managers want to achieve a return to risk above one net of fees. The risks that have to be controlled are also well known. Most managers think that volatility should be set at a target and drawdowns have to be minimized and should be below a well-defined threshold. So it is not easy to find something new that is not subject to data-mine issues and meet these constraints. Consequently, it is important to determine where research could or should be conducted and handicap the chance for something new.

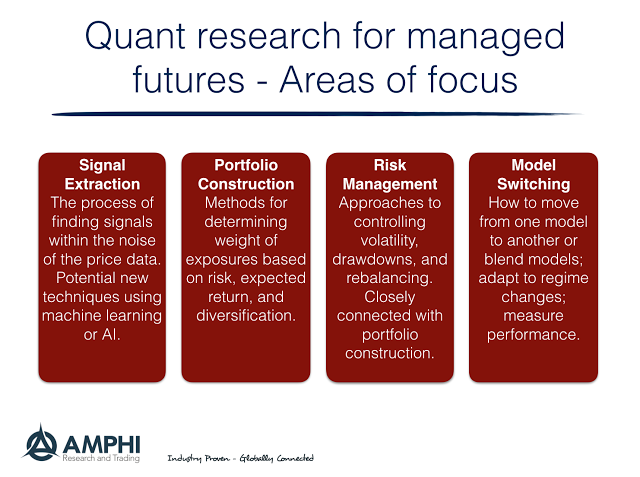

Quantitative research can be separated into four major areas:

1. Signal extraction

2. Portfolio construction

3. Risk management

4. Model switching

While we see there are significant areas for further research, each areas of research may produce different levels of benefit. To start a discussion, here are some simple thoughts on where research will be fruitful.

- Signal extraction – The process of finding improved signals has strong potential using some new techniques like machine learning and AI; however, there are significant barriers to entry based on the knowledge of how to program and developed these models. Unfortunately, we have seen the use of AI models in the past only to be disappointed with the results. New price-based models using older techniques may be limited. There can be some strong gains from the use of fundamental models; however, these models may be subject to issues of coefficient stability.

- Portfolio construction – Employment of new portfolio construction techniques may be limited, but there can be many new ways to form weighting schemes based on the preferences of managers. This can be a fruitful area of research but is closely related to the utility and risk averse of the manager and not the type of model used.

- Risk management – After the strong movement to VaR and risk-weighting schemes over the last few years, there may be limited room for improvements except for the adjustments based on a deeper focus on differences in the distribution (skew and kurtosis).

- Model switching – This may be a fruitful area of research based on determining model performance or forecasting failure and how to dynamically adjust allocations across models based on factor analysis

All of these areas require a fair amount of theory and data research work in order to generate significant results. In fact, our point is that anyone should be wary of a new algorithm or a new approach. Most of what passes for new may be the preference choice of the manager and not a new technique. There is nothing wrong with making models, risk management, or portfolio construction preference choices which may lead to better returns, but that is not the same as a new method of finding value. Perhaps a key research area is focusing on how decisions are made and systematized.