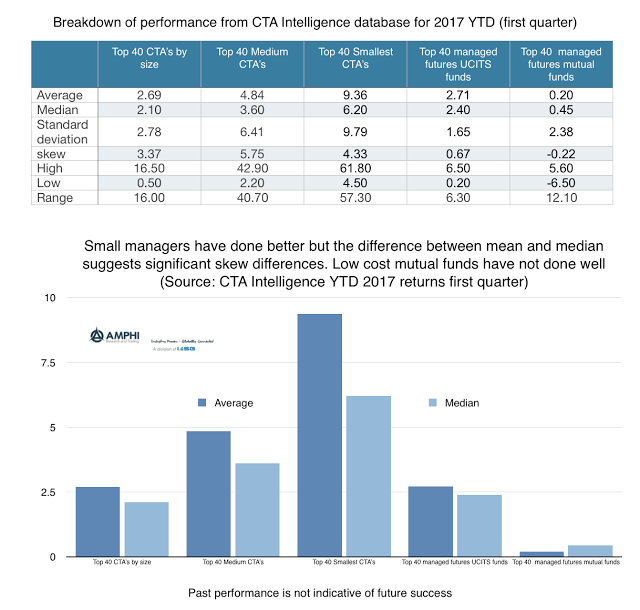

There has been a preference for large managers within the managed futures space as measured by money flows, but it comes at a cost. Looking at year to date performance from the CTA Intelligence performance database shows the differences in performance based on size. What is clear is that the average performance of a set of 40 small managers is significantly higher than the performance of the largest 40 managers. Going down in size will allow clear increases in average return and with median returns; however, a closer look shows that the price of obtaining higher returns can be high in terms of regret.

The standard deviation as one measure of performance spread shows that as you move down in size the range of performance gets drastically larger. One standard deviation on the downside will wipe out the average return for all categories. However, performance does not seem to be normally distributed. There is skew to the upside. More importantly, the range between the high and low manager within a category is multiples larger than the average.

While many may look at managed futures benchmarks, those returns are not usually representative of what you may get from choosing any one manager. There can be large discrepancies between an equally weighted portfolio and an individual manager. This is the price or cost of due diligence. If the wrong manager is picked, there can large downside costs. If right, the gain can also be high. Even in one quarter, a bad pick can be multiples away from the average.

The advantage of buying a large manager is with the clustering effect with performance. The cost of being wrong is minimized. So investors who pick from the large managers may not asking for something better but something that is less likely to be out of step with the rest of the group. Call it safety-first and performance second. Going down is size allows for better due diligence to be rewarded. It is a trade-off.