Money has flowed into managed futures under anticipation that there will be a crisis event that will need the diversification benefits of trend-following strategies. These investors adjusted portfolios away from perceived overvalued assets to the value from long-short diversified trend-following. What is the sense of increasing allocations after the divergent event of a equity sell-off?

The only thing that is missing is the crisis event. There is now the waiting for the event. However, let’s not forget that crises are by definition unexpected, and the value of trend-following is not with their ability to predict these crises. Systematic trend-following is non-predictive; nevertheless, given risk management which will exit losing positions and the ability to dispassionately enter new positions, trend-followers should adjust to a divergent crisis quickly and should be able to exploit an extended decline.

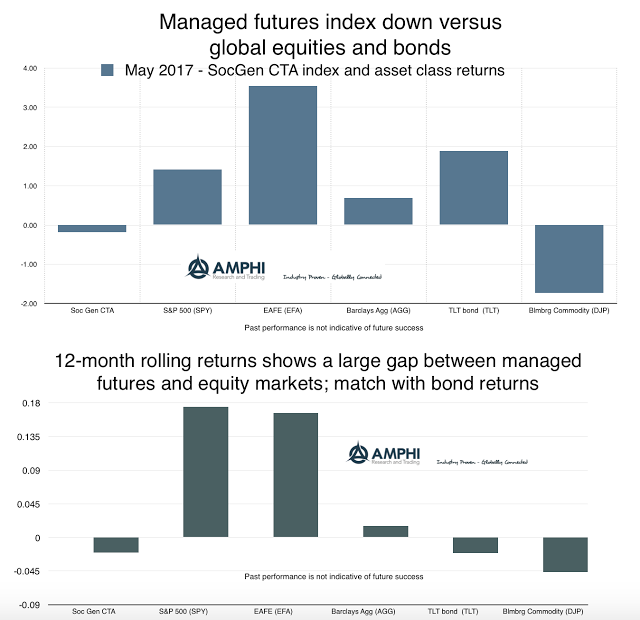

The problem is that forward-looking investors are ready, the strategy is ready, but the markets have decided to continue to move in directions that do not allow managed futures to profit. This month was almost the same as last month with respect to equity and managed futures behavior. A representative index shows flat performance and equities have continued to march higher. There are manager winners and losers this month, but generally, opportunities have not been exploited. Although the dollar declined, commodities in general were lower, stocks trended higher and bonds were up, managers have not found strong opportunities which translate to higher returns.

The 12-month rolling returns show managed futures consistent with long duration Treasury (the other main crisis offset tool) performance. There is an opportunity cost for those who have sold equities and bought managed futures over the last year. We will have to wait and see if the early allocation changes will be rewarded.