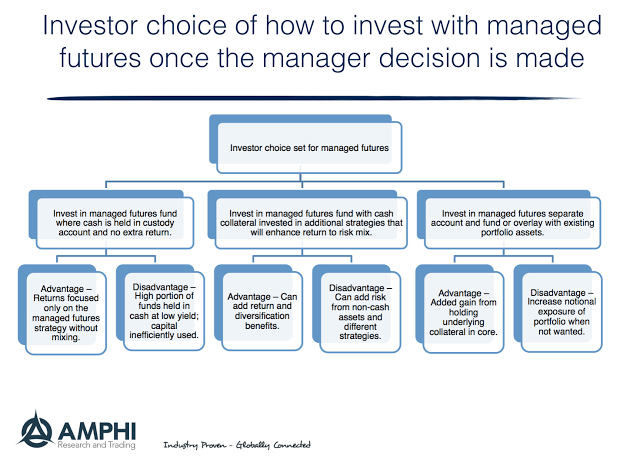

In an earlier post we discussed the issue of using capital more efficiently in a managed futures investment. The premise is simple. If only limited funds are used for margin, the majority of cash associated with a managed futures investment are held in low interest investments. This portion of the managed futures capital can be better deployed to increase returns. Similarly, managed futures can be used as an overlay to an existing portfolio to better use cash. See “Use your collateral wisely and enhance managed futures efficiency”.

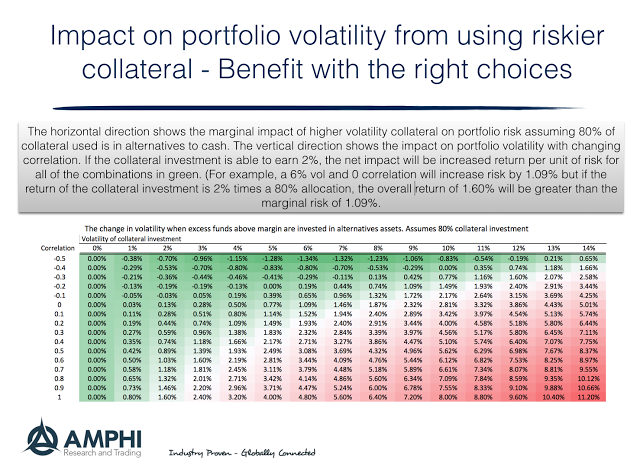

In this post, we use a simple example to look at the trade-off of risk and return when using the collateral more efficiently. We take a simple combination of two assets, the managed futures portfolio and the cash portfolio which we have set at 80% of the funds invested. Our example starts with a managed futures fund that has a 10% volatility in the table below. With the collateral investment in cash, the marginal increase in volatility is zero, so the volatility of the fund is just the risk associated with managed futures trading positions.

Any movement of funds away from cash will be affected by the volatility of the investment and the correlation between the managed futures trade portfolio and the collateral investment. We can first determine the volatility of the overall portfolio when there is an investment in a trading account and an alternative cash account. From this number we can subtract the volatility of the portfolio that just holds cash for collateral. This will tell us the marginal increase in risk from holding alternatives to cash at different volatility and correlation combinations. This matrix can be changed to a smaller investment of collateral to, say 40%. In that case, the marginal change in volatility will be lower as well as the increase in return.

If you invest collateral in a negatively correlated asset, there will be a decrease in overall volatility. If there is an asset that is liquid and can be negatively correlated with the trading account, the fund volatility can be decreased and returns can be increased to improve the fund information ratio. If there is an expected return from the collateral investment, the investor can determine what volatility and correlation combination is necessary to have a positive marginal information ratio. This post shows that collateral management can be analyzed in a systematic manner in order to explore issues of fund capital efficiency.