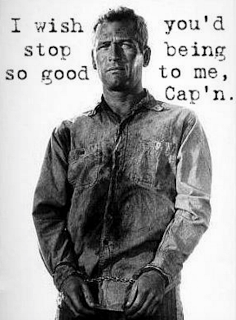

” What we’ve got here is failure to communicate. Some men you just can’t reach. So you get what we had here last week, which is the way he wants it. . . well, he gets it. I don’t like it any more than you men.” – Cool Hand Luke (1967) – The Captain’s speech

The last week was tough on both bond and equity markets around the globe because central bankers were trying to provide “forward guidance” to the market. Central bankers speak and the market will listen and react.

Now, different speeches will have different levels of guidance. For example, FOMC minutes have a lot of formal guidance while a Fed president speech from a non-voting member of the FOMC will be given little weight. Nevertheless, all talk will be given some value by the markets. Unfortunately, the message, in any given central banker statement, may not be heard “correctly” by the market. Hence, markets saw strong price reversals this week in reaction to president Draghi’s comments and then ECB clarifications.

Policy desires and prices may diverge when we have a failure to communicate. Communication failures will punish the markets. This divergence is more likely when the central banks are not trying to provide more than just an appropriate level of liquidity to sustain economic growth and control inflation. Central bankers want to potentially control bubbles and impact the supply and demand for assets through their balance sheet activities, so markets are more sensitive to any comments.

Any comment on valuations and balance sheet changes will be taken seriously and in a manner that is often violent. Think taper tantrums. With central banks potentially cutting liquidity, markets will be biased toward thinking the worst which mean trend reversals. This failure to communicate the right message will generate volatility that will especially hit traders who are risk sensitive to changes in market trend.

Central bankers, please stop being so good to us!