Consistency is critical for any investment style or factor, and it seems that trend-following seems to show it better than most other alternative strategies. It is now almost amusing that when efficient markets ran supreme as the paradigm of choice for market behavior no one was able to find these results, but now that there has been a shift in our views the scales have been lifted from our eyes and we find trend following is accepted through the ages. See the latest research from AQR Capital Management, “A century of evidence on trend-following investing.” which has been updated through December 2016.

I will not say that trend-following is perfect for all times, but the evidence says that it is an effective core strategy that can always be used by any investors. Prices are primal and their trend behavior is a good foundation for any discussion how to form an effective portfolio.

The research numbers shows that trend-following is effective across all major market sectors and long time periods. The Sharpe ratios net of fees are all positive for every decade since the 1880’s. Additionally diversification with equities is strong with correlation with stock indices ranging between -.34 and .33. Both short and long-term trend-following is effective but not necessarily at the same time. The research shows that long-term trend following is not as sensitive to a lagging or delay of the signals.

There is consistency with the benefits from trend-following which just reinforces the same story that marketers of managed futures funds have been using:

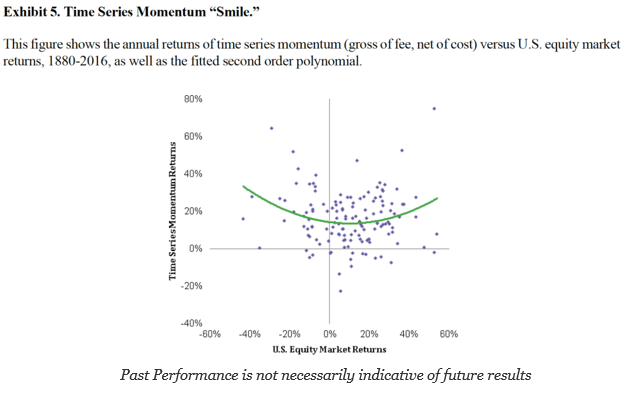

- There is a non-linear relationship with equity returns, a performance smile whereby trend-following does better during market extremes.

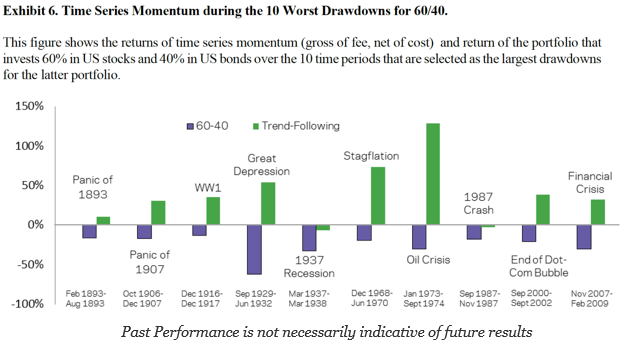

- The trend-following portfolio will do well during times of market stress. The research focuses on comparison between trend-following and a 60/40 stock/bond mix which is more representative of an investor’s portfolio than 100% equities. Trend-following will add return at critical times.

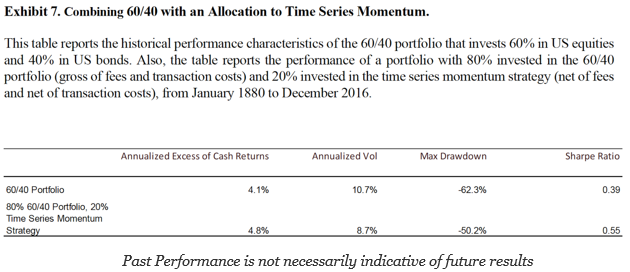

- When added to a 60/40 stock bond portfolio, trend-following will add return, chop volatility, improve the Sharpe ratio, and cut the maximum drawdown.

Questioning current trend-following performance should be expected, but location decisions should be based on prior evidence. The current drag on performance form holding a trend-following manager is real, yet the long-term evidence suggests that a trend-following is useful and patience should be a guide when making allocation changes.