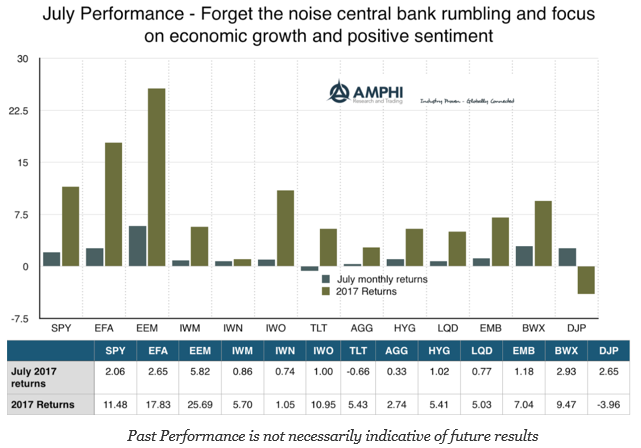

The drumbeat of over-valuation continued in July, but investors do not seem to be listening to any negative stories as stocks around the world continued to move higher. The view that economic growth will pick-up in the second half of the year coupled with rosier earning forecasts have pushed equities higher. Any worry about valuation will be for tomorrow. Today, the focus is on buying risky assets around the world.

Of course, if you were looking for reasons to be negative you could find them just below the surface. First, a good portion of the strong international gains was associated with the dollar decline. The DXY index fell just under 3.5% for the month. Second, small cap and value indices did not do as well as large cap names. There is a concern over the breath of the current rally.

Bonds have been more mixed with US long duration showing the only negative returns. This should be expected given the disclosures on the balance sheet unwind. Nevertheless, inflation cannot move beyond 2% so bonds are not considered as risky as few months ago.

International bonds were positive only because of the dollar move, but credit spread tightening continued to on further flow into corporates. The mixed signals from central banks made for a more difficult fixed income environment for active traders. Bond investors are realizing that the great liquidity gains of from QE are over or reaching twilight. The Fed has made clear its intentions for reducing its balance sheet. The ECB is only sitting on the fence given the retreating inflation numbers in the Eurozone. Liquidity concerns should increase but it seems as though this will have to wait until after summer holidays.