The month began with some very promising trending opportunities, but with some choppy moves in both bonds and commodities, returns were generated by those who were nimble at position-sizing and getting out of losing trends before profits were completely given back to the market. This was a month where trend timing length mattered. Long-term trends ride through short-term choppiness. Short-term trend following is often able to profit and exit on reversals. A difficult problem is matching model to trend length and is often the reason for a diversity of timing models.

The truly bright spots were in currencies where the dollar decline again returned in earnest. These were not, however, one way moves, currency jump coupled with reversals may have hurt shorter term traders. Economic announcement especially from central bank are a key driver of short-term noise.

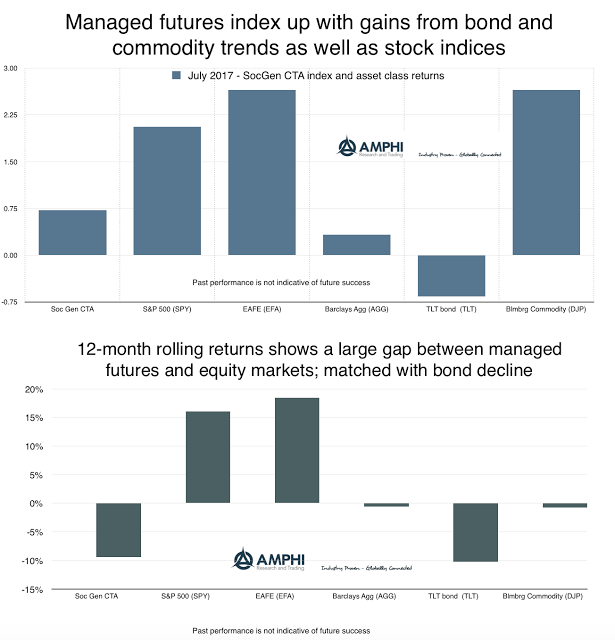

Again, there seems to be strong dispersion in manager performance that is masked by the positive gains in the SocGen CTA index. The BTOP50 index was also positive although slightly lower at .51 bps. The SocGen short-term index was down slightly for the month and has had a more difficult time in 2017 versus the longer-term trend-followers.