We have already focused on the US Marine Corps’ approach to risk management. Still, the Marine Corps is not alone in the military in formalizing approaches to decision-making under uncertainty. The US Army addresses the issue with a variation on the problem in its risk management manual. Again, the focus is on process and discipline, which should be the focus of any risk management program. A common theme is having a solid risk process to respond to uncertainty.

The US Army focuses on four main principles: integration and decision-making at the right level, continuous assessments, and constant weighting of risk return.

The principles of RM are:

- Integrate RM into all phases of missions and operations

- Make risk decisions at the appropriate level

- Accept no unnecessary risk

- Apply RM cyclically and continuously

US Army’s Approach to Risk Management

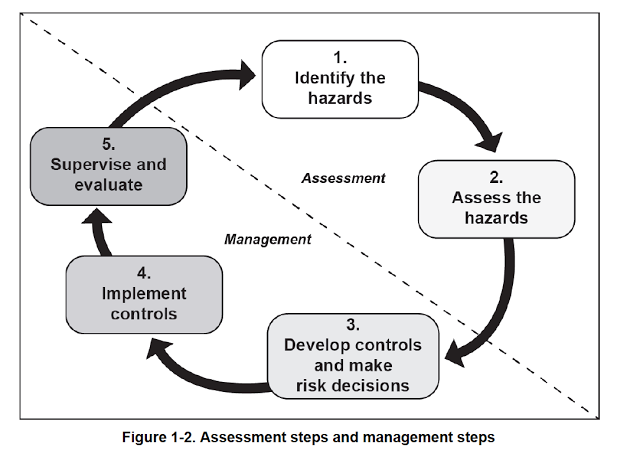

The US Army’s five-step risk management process has two significant parts: assessment and management. It requires measuring risks, taking action, and then evaluating them in a continuous loop. Feedback and reassessment are critical to the process.

Risk Assessment Matrix

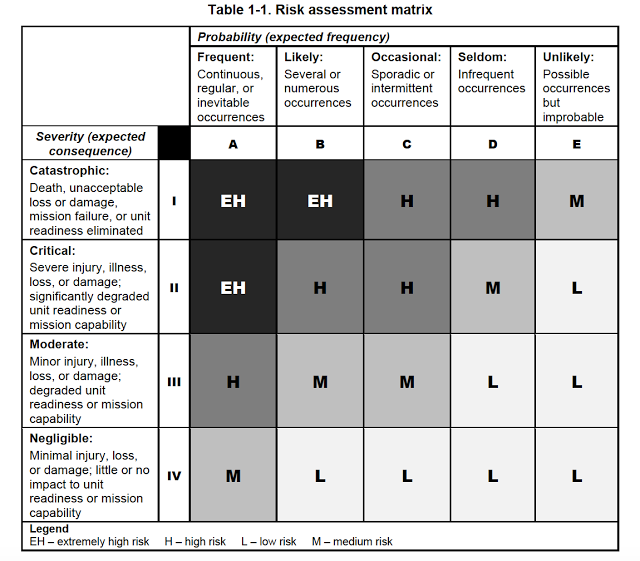

A risk assessment matrix does an excellent job of matching the frequency of risks with the event’s severity and determining the risk level. This approach may be helpful for many money managers. A threat-harm trade-off determines the level of risk for a portfolio. Although not inconsistent, this framework offers a different perspective on risk than the classic return-volatility framework.

Criteria for Effective Controls

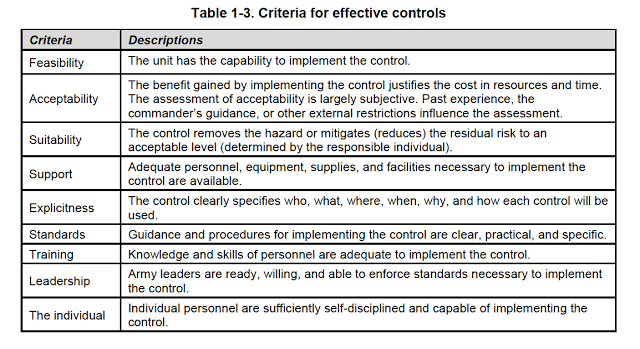

Another interesting matrix from the Army is their criteria for adequate controls. This table matches activity with risk controls, which help define organizational roles. These criteria can easily be mapped into the activities of a money management firm.

Comparison with Asset Management Risk Management

Asset management risk management seems to focus on mapping risk into a return-volatility or VaR framework and spend less time on the process. The Army has to focus less on countable events and more on uncertainty. Consequently, the process may have more value than statistics.