The book, The End of Theory: Financial Crises, the Failure of Economics, and the Sweep of Human Interaction by Richard Bookstaber touches on the important idea that markets are driven by a diverse set of agents who have different objectives, levels of rationality, rules for making decision, and market power. The book makes a strong case for throwing out the existing theories that often rely on representative agents in order to more effectively explain the messy business of modeling financial markets.

I am sympathetic to the main points presented by Bookstaber, and hearken back to the older age industrial organization work that focused on the dynamics and structure of players in a given industry. The description of the environment and how institutions enact is critical to understanding the dynamics of markets. Changes in regulation, adjustments in market practices, and the employment of market power all lead to situations which could not even be imagined in a world with atomistic similar agents. The representative agent approach, by assuming everyone is the same, naturally leads to market efficiency stories. There is no room for diverse behavior. An agent-based approach allow for ebbs and flows in efficiency based on the weight of different market players.

More important for quant modeling, an agent-based view of markets focuses on more than just prices to help make better investment decisions. I have always been of the view that “prices are primal” and this is the best starting point for any market analysis. Price analysis can often be enough for finding market trends and making investment decisions, but secondary sources of information may be helpful for reinforcing price signals and identifying turning points.

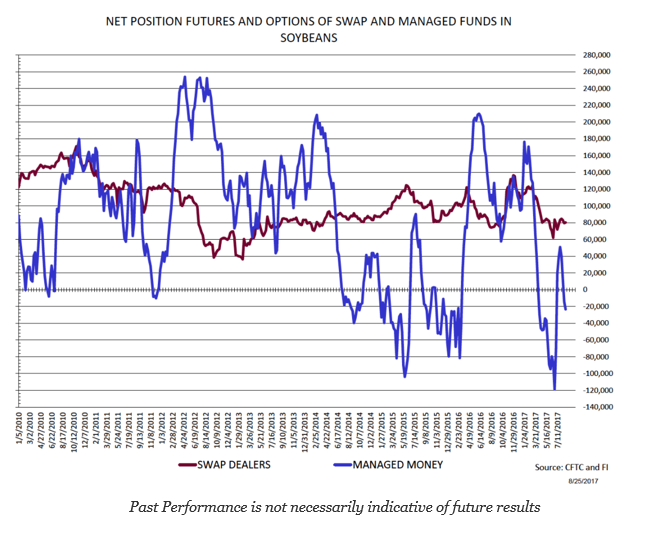

A classic example of using an agent-based approach to help with investment decisions is using the commitment of traders from the CFTC. The quality of the data has improved over the years with a finer breakdown of users categories and less delay in reporting. It is still not real time and there is significant noise in the data, but strong changes and extremes in positioning is a good reinforcing tool to price behavior.

The soybean chart of managed funds positioning provides a good story of when money was getting short and when it was reversing in response to a price increase. By itself it is not a good signal but with price, positioning information can reinforce what is happening in the market. This is especially true at extremes. Of course, given the availability of the data, many simple filter tools like the commitment of traders have to be recast in order to create an edge.

The agent approach can be used to generate market context and color and can be further refined to include large trades, volume, and open interest. Given the success rate for trend trades is usually less than 50%, tools that condition or filter signals are extremely useful.