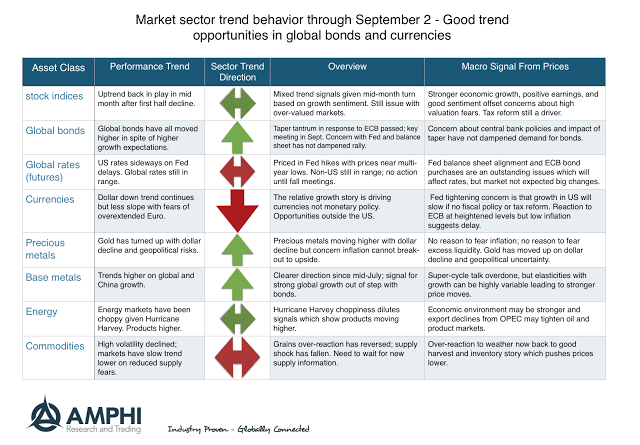

Many of our trend indicators were mixed coming into last month but continued gains in currencies and a strong bond rally positively contributed to performance for many CTA’s. The current trend indicators suggest continuation of these existing price moves. We take a representative sample of markets in a sector and count how many have up or down trends to form a sector estimate. The sector estimates can be strongly up or down or more neutral with a bias up or down as indicated by our arrows.

Stock indices sold-off earlier in the month only to rally during the second half on positive sentiment concerning tax reform and less aggressive Fed talk concerning its balance sheet. Bonds continue to move higher albeit with weaker slope. Currencies also continue their trends, yet the momentum against the dollar has slowed. Precious metal moves have been tied with currency trends. Energy markets have been affected by hurricane volatility and commodities are biased lower.

While some of the strongest trends last month may reverse, our general view is that trends often last longer than expected and without a policy or economic surprise, there is little reason to see a change.