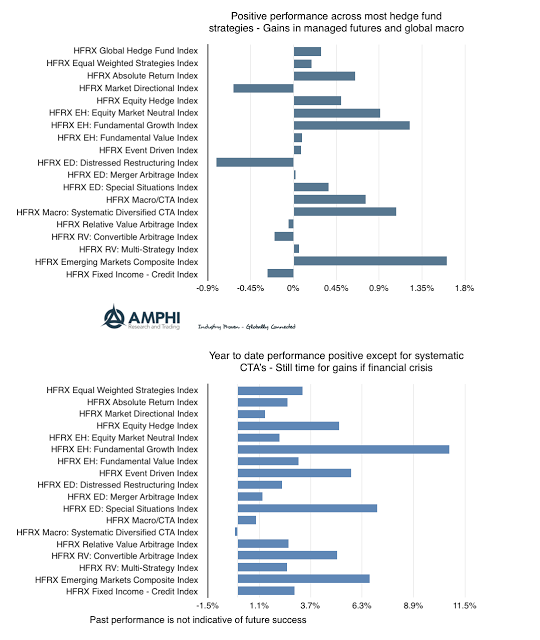

While stocks were mixed with performance down for the month in with growth, value, and small cap benchmarks, there was a general increase in hedge fund returns for August. Equity-focused hedge funds gained from the added dispersion in returns across sectors and individual stocks. Evidence suggests that active management relative performance increases when the correlation across stocks decline.

The biggest gains were in EM hedge funds which is in-line with the strong gains for benchmarks. Global macro and systematic CTA’s also did well for the month on bond, currency, and selected commodity moves.

All hedge fund strategy benchmarks are positive for the year except for systematic diversified CTA’s. The best performer for the year has been the fundamental growth category followed by special situations. A test for hedge fund investing will come this fall if there is an increase in market volatility and an adjustment in valuations.