“Maybe you could tell me what is going on. And please speak as you might to a young child. Or a golden retriever. It wasn’t brains that brought me here; I assure you that.” – Margin Call (movie)

There are two communication problems with global macro investing. First, the stories used to explain the global macro economy are confusing, contradictory, and haven’t proved to be true. This is an outgrowth of the poor forecasting of macroeconomics in general. Second, the stories used to explain the investment process especially for quants goes over the head of most investors. A discussion of techniques is not an explanation for how returns can be generated. Managers need to work on their narratives to ensure that investors understand what they do and why they make money.

These two issues are more acute given the way these global macro and managed futures programs have been sold. Managed futures managers have presented the story that their strategies will do well during a financial crisis given past low or negative correlation, yet this correlation benefit is not a certainty. Investors do not really know what to expect from these managers given there have not been good narratives to explain why there are low correlation benefits.

We will not present a general narrative for the benefit of managed futures or global macro at this time, but will suggests some questions that have to be answered to provide a good narrative for any firm. There is no magic formula for providing the right narrative but any story has to have a well-defined beginning, middle, and end. A firm’s narrative is like a journey. The first part is how the manager got to the point of having a unique strategy, the middle is the challenge for how the investment problem faced will be solved, and the third part or end is the performance or the results from the strategy.

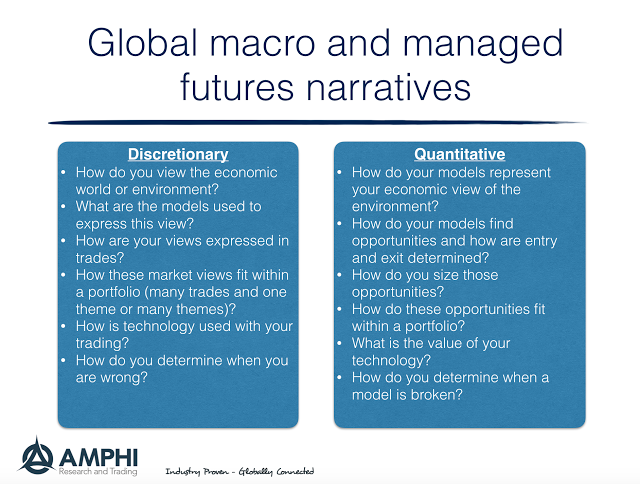

Below is a list of some simple questions that should be included in any narrative.

Whether discretionary or quant, a good narrative starts with a view of the economic world or environment. The worldview places decisions and modeling approaches into context. The worldview concerning the behavior of markets needs to then be expressed in trades and in a portfolio. An important question is whether trades represent multiple themes or variations on one theme. A good narrative also discusses how technology and research is used to generate returns, and will discuss when there is failure and how it is overcome.

Without a good narrative investors cannot understand the firm’s value-added and appreciate when a strategy will have benefit. Unfortunately, even successful managers do not spend enough time developing their story and do not peak to their investors in ways that are clearly understandable.