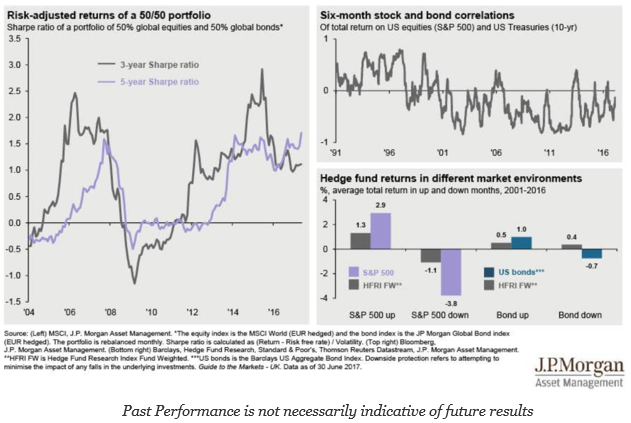

The key challenge for many global macro and managed futures managers (or any hedge fund combination) is showing their relevance during the post Financial Crisis period when the simple combination of stocks and bonds seem to have been enough to generate a very effective Sharpe ratio.

Hedge fund managers need to show their value-added in an environment where the negative correlation between stocks and bond has allowed the two-asset class blend to do an effective job of diversification.

The performance numbers above show that the stock-bond combination value is dependent on two assumptions or environments. One, there has to be a negative correlation between stocks and bonds. Nevertheless, this correlation has been variable and at times positive. Two, there has to be a positive stock return environment. The current rally is not the longest but is becoming longer than average for the post-world war environment. It may not last. Both conditions cannot be guaranteed, so diversification through hedge funds is still relevant even if it is not case for a selected period.

Nonetheless, instead of comparing performance or value-added to a stock index, the relevant benchmark should be a stock-bond blend. This is a higher hurdle for hedge fund value-added, but is more realistic because investors are already starting with a diversified portfolio. Hedge fund relevance is based on the marginal contribution to an existing portfolio not against a single asset class.