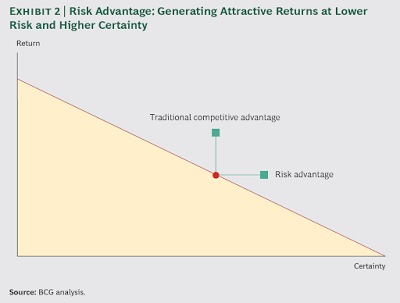

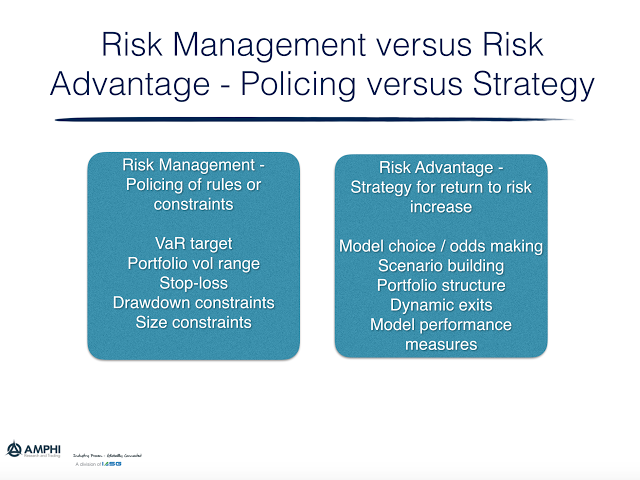

There has always been a lot of talk about the competitive advantage of a firm. For money managers, it has been about their edge. However, there is a new focus by some consulting forms about a firm’s risk advantage. (See BCG’s Henderson Institute – “Taking Advantage of Risk” and the BCG’s Perspectives piece “From Risk Take to Risk Manager”). This strategy work has focused on a firm’s “risk advantage” as an alternative to competitive advantage. Firms that manage their strategic risk options can add value relative to those that look at risk management as a police function.

While many implicitly may think about the broader image of risk advantage, there may not be a clear emphasis on the advantages of risk management as a tool for comparative advantage.

As risk premiums are further identified and enter the public domain, the firm differentiator is the ability to adjust and adapt the risk exposure. Instead of risk management as a traffic cop function, risk-taking and management is a choice which must be decided upon no different than a return choice.

There is a duality between choosing return or risk. They cannot be separated. Risk advantages at the strategy level can be expansion anticipation through scenario analysis and looking ahead at what is possible, discipline will choosing the right risks through choice metrics, and the ability to show resilience through coming back from bad outcomes.