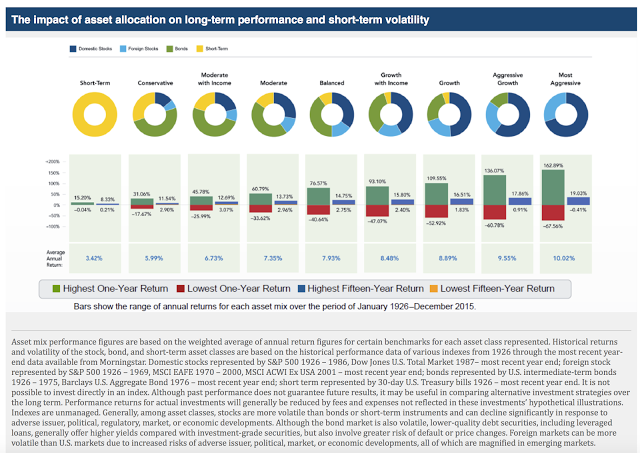

There is no question that research shows that asset allocation matters. It matters more than stock selection and it matter more than manager selection. But, it is sometimes hard to visualize what is the impact of different asset allocation choices. The following table from Fidelity’s Market Snacks is enlightening. The table of average annual return is completely expected. If you increase risk through more aggressive asset allocations, return goes up. The movement from conservative to aggressive over the long-run is linear; nothing new here.

However, if you look at the risk as measured by the best and worst year or the best and worst fifteen-year period, the impact of investing at the wrong or right time is stunning. Holding an aggressive portfolio at the wrong time is very costly while being aggressive at the right time is very profitable. Any change in the asset allocation mix can have a meaningful impact in both the short- and long-run. Some could respond that since predicting the market environment is so difficult, asset allocations should not be tried. Investors should look at you risk profile or point to the life cycle and that should be enough for making long-term decisions.

An alternative view to the problem is that more aggressive allocations need to be matched with more aggressive downside protection or active switching across asset classes. Portfolio protection and risk-taking should be taken through diversification to specialized asset managers who can adjust more quickly global asset allocations than most investors.

We believe that this is one of the chief reasons for holding global macro and managed futures. Managed futures will provide for better downside protection during those times when the market is in turmoil and there is a chance for a large market decline. The manager can switch exposures quickly through trading futures both long and short.

There is a need for downside protection and also more upside potential when there are large market divergences. Managed future will provide positive convexity or gamma within a macro portfolio. Of course, convexity and downside protection may come at a cost, lower stand-alone returns when the markets are calm. Consequently, some of high returns from an aggressive allocation can be used to pay for the lower returns from managed futures during good times. In exchange for this asset allocation strategy diversification payment, the large dispersion in downside returns in the short-run is dampened while still allowing for upside divergences.