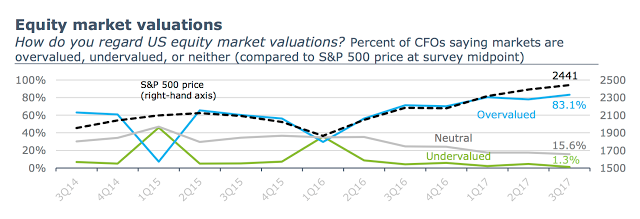

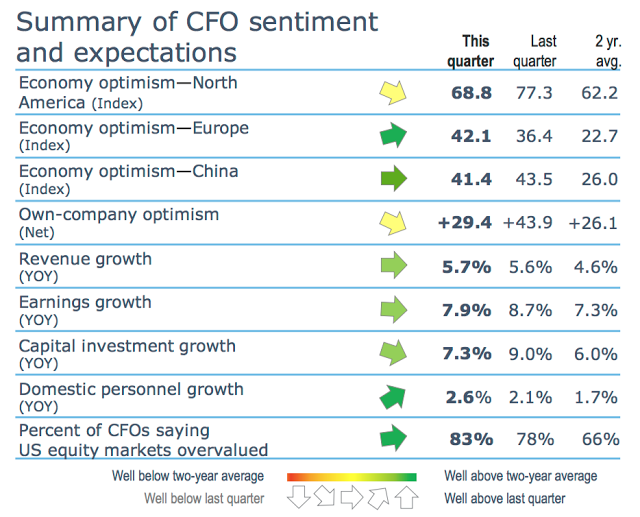

The Deloitte CFO quarterly survey should give any investor pause for concern. The numbers for this quarter show that 83 percent of those surveyed believe the equity market is overvalued. The number is at all time highs but has been around 80% all year, in spite of the market continuing to go up. Perhaps the CFO’s forecasts are wrong; however, I have more concern from the economic sentiment and expectations.

Economic optimism for North America is declining. Company specific optimism is also falling. Revenue and earning growth are moving sideways. The only real positive is European economic optimism and to a lesser extent domestic personnel growth. The combination of overvaluation and less optimism should make any market correction more likely.

As we begin the fourth quarter, the survey suggests that plans for more defensive asset allocations should be pushed forward with less delay. Now, the tax plan that many have been hoping for has shown some signs of life since the survey, but its complexity suggests that, at this time, it will not change the current CFO sentiment.