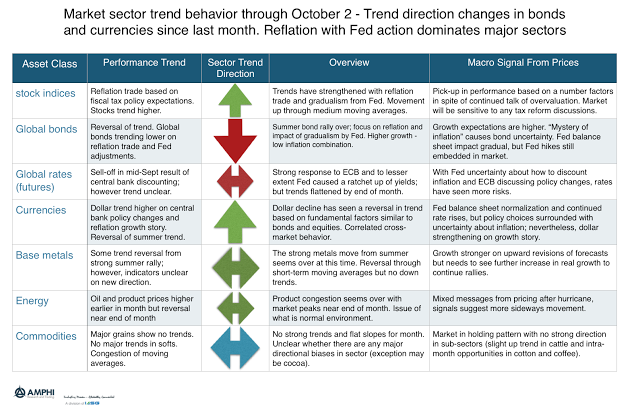

The trend story for September was an end to the summer bond rally, a pick-up in equity trends, and a new interest in buying dollars. Without major strong trend opportunities in commodities, the reversal in bonds and currencies hurt many managed futures traders.

The market trends switched directions based the three major policy announcements. First, with more talk of the tax cuts and reforms, the reflation trade is back in play for US equity markets. The up trend for stocks has accelerated based on potential fiscal stimulus. The view of the markets is to forget valuations, they can always be worried about tomorrow. Second, the ECB mixed message of more bond purchases but a decision on the ending of QE to occur in October was viewed as bad for bonds. With so much buying pressure from the central bank, a end of the program will have flow effects. Third, the announcement of Fed balance sheet adjustments coupled with talk about the mystery of inflation was bond negative. Anyone should fear duration risk if there is no understanding of inflationary expectations.

Trend following is non-predictive. Hence, it is hard to say whether current trends will continue. Our measure of trends at the end of the month does not represent a forecast, but an uptick in growth and less structural liquidity from central banks may mean that the new trends of September will stay with markets in October.