Barron’s published a provocative piece from my friend John Curran, The Coming Renaissance of Macro Investing: The petrodollar system is being undermined by exponential growth in technology and shifting geopolitics. Coming: a paradigm shift. The concept behind this regime shift or dislocation ties together finance, technology, and global trade. Changes in the flow of trade based on shifting patterns of economic growth with disruptions in technology are going to spill-over to financial markets and prices. Capital flows are reactive to broader movements in power, politics, economic growth, and trade.

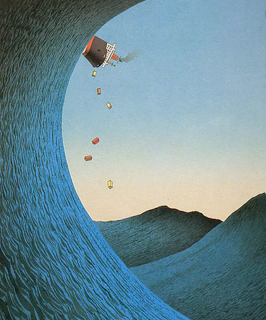

Look back at Schumpeter’s concept of creative destruction. Changes happens when alternatives teardown the existing order. The shifts in energy demand, the adjustments in power from seller to buyer, and the disruption in technology that underpin the oil market will all impact capital flows between the seller who receives dollars and the buyer who pays dollars. The last 45 years have been based on trade flows working in concert with dollar flows. If the oil trades moves from west to east, finance with follow.

My take-away from John’s piece is that disruption and creative destruction is an opportunity for global macro managers who trade cross-market linkages. In the language I like to use, macro managers who are divergent traders or long volatility will be rewarded versus those convergent traders who are looking for markets to move or stay in equilibrium. Divergent traders place themselves in a position to make money when market dislocate. An end to a petrodollar world is the type of dislocation that offers macro opportunities.