The marketplace is abuzz with the value of momentum trading, but a closer inspection shows that it is packaged in two major strains, time-series, and cross-sectional momentum. The traditional trend-following CTA focuses on time-series momentum, while most of the equity research and implementation is conducted through the cross-sectional approach. There are similarities between these approaches, but there are also enough differences so that the return profile for each will not be the same.

Many CTA’s now have a hybrid approach between times series and cross-sectional momentum, so it is critical for investors to know the differences. Time series momentum will focus on absolute performance, while cross-sectional momentum will focus on relative performance. The times series is only focused on whether a specific market is moving up or down, while cross-sectional work will rank markets to buy the best momentum markets and sell the worst. Finally, the cross-sectional work attempts to generate a momentum alpha, while the times series approach mixes alpha and beta.

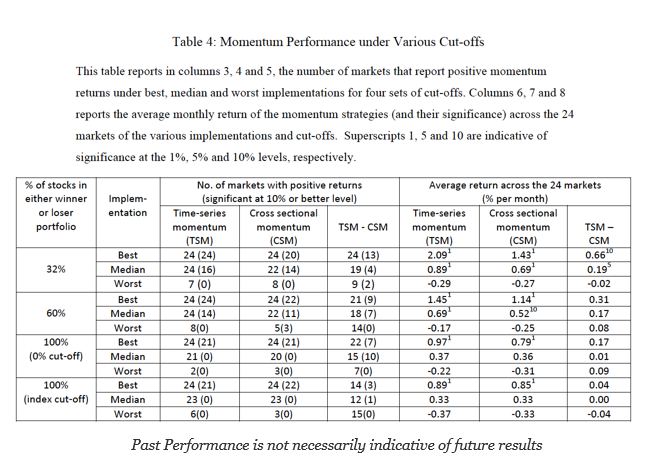

A recent paper called “Time-series and cross-sectional momentum strategies under alternative implementation strategies” suggests that time series is superior because it does not place constraints on the winner and loser portfolio. This research is focused on a portfolio of stock indices, but the intuition can be used to help describe different managed futures approaches.

Think about this issue through a simple example. Assume that a manager is trading 20 commodity markets. The times series approach will look at each market separately so that if 12 markets are showing positive momentum, there will be twelve long positions. If eight markets show negative momentum, then eight would be the number of short positions. The long or short mix in the portfolio is independent of the number of markets traded. In a cross-sectional momentum model, all the markets will be ranked, and if there is a cut-off of, say 20%, the top four would be long, and the bottom four would be short. The rest would be ignored. There would be fewer positions to manage, and a cut-off would set the positions based on the number of markets in the sample.

The time-series approach will have variable diversification given the long and short positions would be dynamic; however, the size of each may be smaller since every market may be traded. The cross-sectional approach will focus on a limited set of markets based on relative signals. The long and short positions will always be equal. Hence, there will be less “beta” risk. Nevertheless, the better approach will change with market conditions based on the strength of market direction across the set of markets traded.

An initial reaction would be that you get the best longs and best shorts through the cross-sectional approach, yet there is a problem if the market has a strong up or down bias. The profitability of momentum strategies may be market-dependent. If there is a strong long (short) bias, it will be harder to find short (long) positions. This market tilt makes the times series approach more attractive. Similarly, if the extremes have a greater tendency for reversal, the times series approach may do better.

The preference for times series or cross-sectional momentum may be a function of the diversification and directional bias within an asset class. There may be diversification benefits from using both approaches. This may be why many CTA’s now choosing to blend time series and cross-sectional. However, the research does show that regardless of approach, momentum is still a factor worth pursuing.