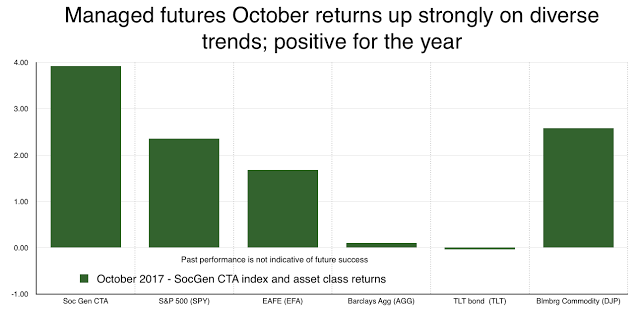

Managed futures returns exploded to the upside with index returns showing big gains relative to alternative asset classes. The positive skew for some managers was even more surprising. We saw some October returns as large as 14%. Every major index we track was close to 3% or higher. For example, the October return using the Morningstar managed futures category was positive 3.45 and the year to date return was up 1.85 percent.

So what was the cause for these strong gains?

• There was no volatility spike.

• No financial crisis.

• No equity meltdown.

• No explosive set of market break-outs.

• No strong market predictions realized.

• Just some good intermediate trends.

• Strong signal to noise allowing for larger position sizing to take advantage of market divergences

The performance drivers were clear. Strong dollar uptrends and oil price increases coupled with continued equity gains. Add to these trends a slight bond decline with bund increases as well as some selected commodity moves and you have a strong month. The size of the gain was surprising in the context that there was no large market dislocation, but multiple market gains can accumulate.

These types of moves should not be discounted given the structure of managed futures to sell losers through strong stop-loss management and holding onto winners longer than what behavior finance would suggest. This combination always for positive skew which was the hallmark of this month’s performance.