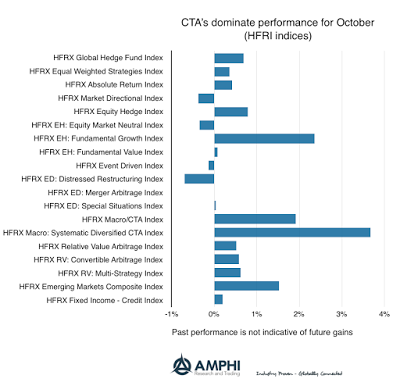

CTAs showed their strongest performance of the year in October. Only the fundamental growth strategy came close to generating the returns seen in managed futures for the month. Some strategies actually posted losses for October even with the continued increase in equity returns.

Managed futures will do best when there are trends outside the normal equity bond mix. With increases in the dollar, energy complex, and selected commodities, CTA’s were able to find profitable opportunities.

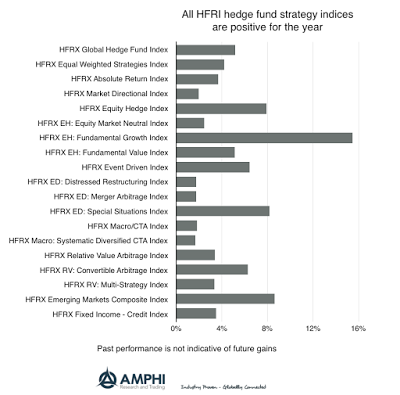

All hedge fund strategies are now posting positive returns for the year. The best returning strategies are fundamental growth, special situations, and emerging markets. Most strategies have some combination of beta and alpha generation; consequently, the strong absolute gains in equities help hedge funds with performance.