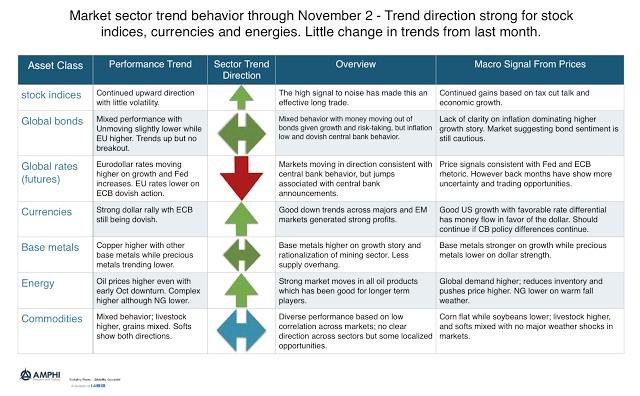

You could call it the second reflation trade. Based on economic data trends which suggest stronger global growth coupled with tax reform/cut talk, we are seeing major sectors show increasing trends and opportunities. The good October trends seem to be carrying over to November. The reflation trades has driven stock indices, energy, and base metals prices higher. The differential between monetary policy in the US and the rest of the world also suggests dollar strengthening. The rate differential is in favor of the dollar. This dollar strength places downward pressure on precious metals. Bond price behavior has been a little surprising with some recent gains in spite of the strong growth story.

Our general view is that October trends will continue given current price action relative to different trend timeframes and break-out models.