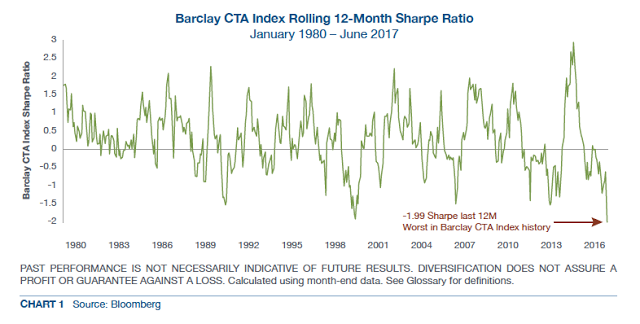

Managed futures have been in a significant drawdown with poor Sharpe ratios over the last two years, albeit October has been a good performance month. Many investors have discussed throwing in the towel and getting out of this hedge fund strategy. New investors have focused on other strategies and not wasted time with CTA’s. A simple approach of looking at recent performance would not be compelling, yet a closer examination shows that this may be one of the best times to invest in managed futures. Forget the recent performance or, more specifically, do the opposite of momentum investors and buy on the dips in risk-adjusted performance.

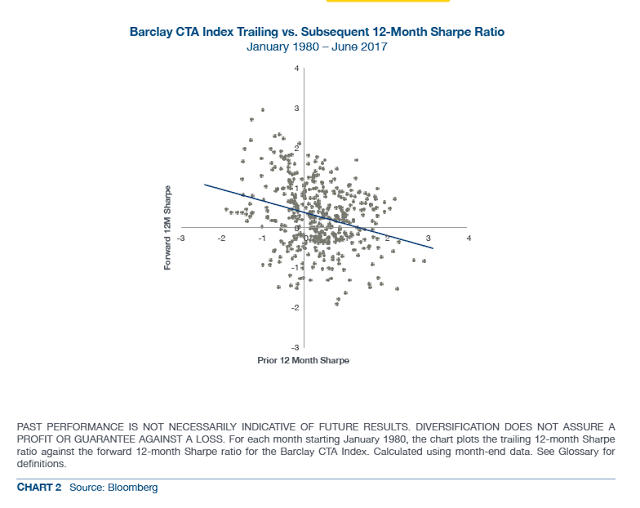

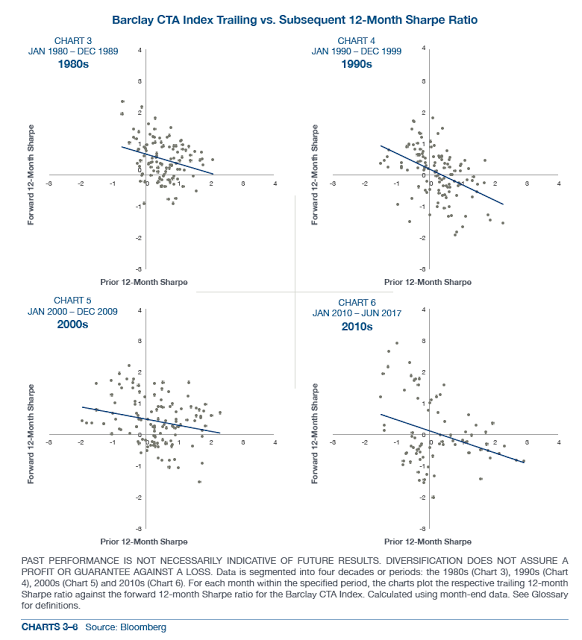

The investment people at Steben and Company have published a good piece of research on market-timing of managed futures called “Can you Time Managed Futures?”. Their results suggest mean reversion or negative autocorrelation with 12-month Sharpe ratios. Periods of very low Sharpe ratios are followed by strong risk-adjusted returns.

Simply put, buy the dips if you want to increase your allocation or invest for the first time. This mean reversion is present in every decade for the Barclays CTA index.

This does not address the question of what manager you should buy to increase your allocation, but it is a good start at timing this hedge fund strategy space. We are currently researching how to choose which manager uses a similar methodology of timing risk-adjusted returns.

Investing in any one manager is more complex, but the general timing decision may be easier to address. For example, when the investment committee likes management futures, the least may be the period when you should love it the most. On the other hand, if you are holding managed futures and ready to divest, think again; it may be worth waiting for the reversal.