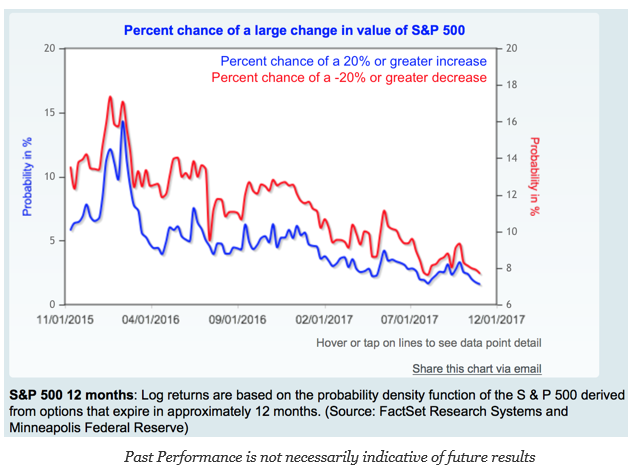

From the Minneapolis Fed we have market-based probabilities of a large up or down market move embedded in 12-month options. This is a good market-based view of a large up or down stock market move.

If we look at the numbers from a year ago, the probability of a 20% or more down move was more than double the chance of a 20% up move over the next year; (13% versus 5%). Now, the chance of a 20% down move is approximately 8% and the chance of an up move is about 2%. The market has a tighter range but the change of a down move is still much higher than an up move. There is still skew to the downside but likelihoods have fallen.

These volatility numbers will be tied with market moves, but right now it is hard to argue that there will be a large market moves given the chance of 20% down move has declined by close to 40% and a chance of an 20% up move has dropped by over 50%.