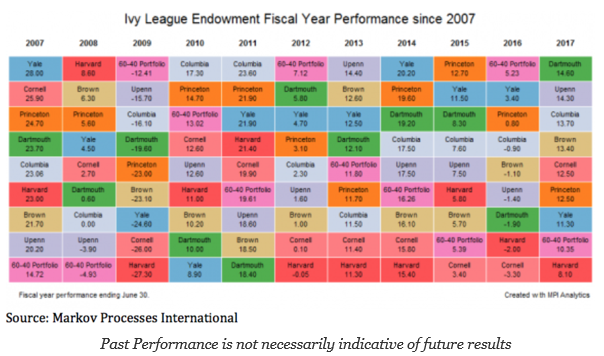

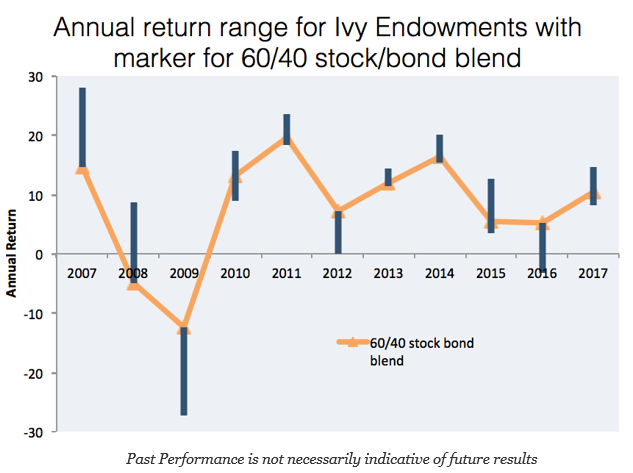

The latest performance numbers for Ivy League endowments have been nicely displayed in the chart below along with the 60/40 stock/bond portfolio. Since the development of the “endowment” model associated with Yale and the attention on Harvard, the largest endowment, there has been an unusual focus on these funds. There is a fair amount of dispersion between the best and worst managers in the group.

Nevertheless, investors can compete against these more sophisticated funds by even just holding some variation on the 60/40 stock/bond mix. Three of the last ten years have seen the 60/40 mix at the top of the rankings. Twice the 60/40 mix has been at the bottom of the grouping.

A large portion of the Ivy endowments has been associated with illiquid private equity investments. The 60/40 stock/bond investment blend is a liquid portfolio. It is possible that adding liquid assets that have higher returns than bonds or further diversification characteristics can generate more competitive returns to a simple 60/40 mix. A liquid investment strategy approach can compete with more sophisticated managers.