The asset allocation decision concerning the addition of alternative investments, especially for diversification strategies, is actually quite straightforward. One, find strategies that have low and stable correlations with stocks and bonds. Two, find strategies that have a minimum acceptable return that will beat a traditional diversifier.

The diversification criteria are easily measured. Look for stable low correlation strategies across a market cycle. Of course, longer track records are required to conduct this analysis. Correlation stability is critical during a crisis when it is expected that correlations will rise to one for many asset classes.

Bonds have been a good diversifier given their negative correlation to stocks and their ability to generate gains during flights to quality. Nevertheless, the negative stock-bond correlation, which has been a fixture for portfolio construction, may not always exist. Hence, it is also important to look at return alternatives.

A minimum acceptable return is relevant because the forecasting the expected returns may be difficult. The focus should not be on current returns but whether a given strategy can be consistently above a minimum threshold through accounting for the expected return and volatility.

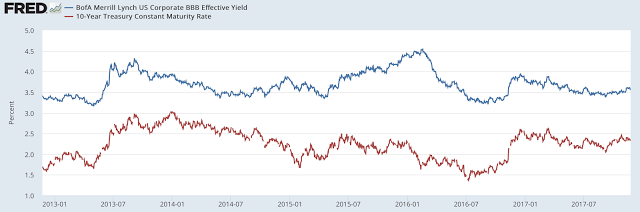

So what should be the minimum rate of return that is necessary to switch from bonds to an alternative asset? The stand-alone yield for bonds is a good measure. The current yield would be the combination of the Treasury yield with any carry excess from credit. From the graph, the current Treasury yield for a 10-year bond is 2.35%. The yield for a BBB bond is 3.60%

An alternative should have an expected return of between 2.35 and 3.6% to match the yield between a Treasury and investment grade corporate bond. Of course, there is the impact from a change in yield. If bond yields fall there will be a gain based on the yield change times the duration of the bond. If yields rise, the break even will be lower as the return declines.

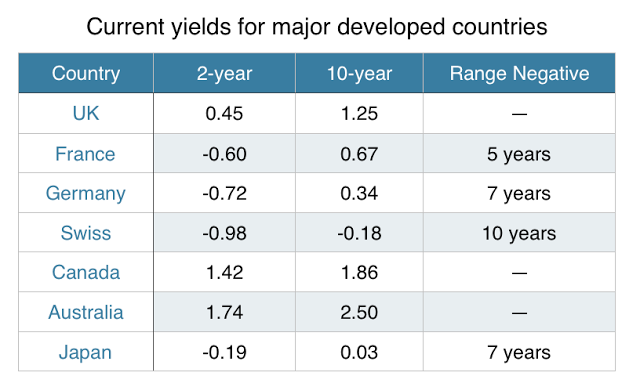

The case for switching in the rest of the world is significantly greater with many current yields negative in Europe and all 10-year yields below the US except for Australia. You have to go beyond 5-years and out to 10-years to get a positive yield in Europe. This is not new information, but it is important to highlight the low cost of switching especially in a rising rate environment.

The switch to alternatives, especially for diversifying strategies, is still attractive. The case is further strengthened if there is an expectation that rates will move higher and dampen fixed income total returns.