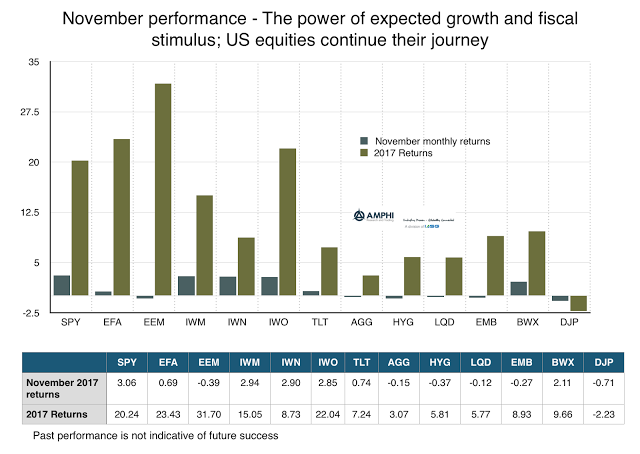

A combination of good economic growth news and a fiscal policy tailwind again drove US equity markets. The discounting of a US fiscal accelerant shows up in the positive US-global return differential for the November.

Small cap, value, and growth all showed strong performance, yet there were some surprises along the return spectrum. For example, long bond performance was positive in this high growth environment. Credit, on the other hand, generated negative performance. The search of yield continues but rumblings about tight credit spreads have caused some to avoid adding to positions.

In spite of the strong US growth story, the dollar declined provided added return opportunity for developed market fixed income. The underperformers for the month included emerging markets stock and bonds. Commodities continued to show lackluster performance even with the positive economic growth story.

The take-away from November is that continued holding of risky assets is a profitable choice. There is no question that excessive credit has driven the gains in equity assets and that any reversal will be magnified by leverage de-risking, but this warning story can last a long time without being realized. The opportunity cost of not following trends is high.