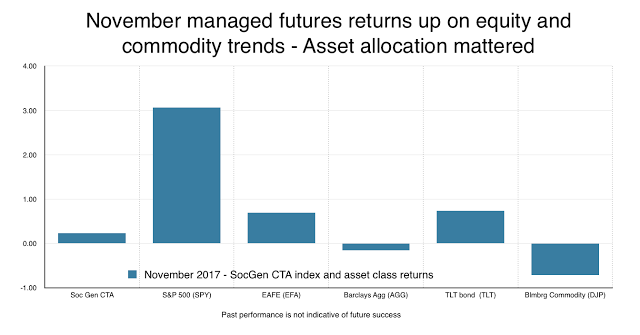

Managed futures managers were, on average, positive for the month with returns beating commodities and the fixed income Barclay Aggregate index. Managed futures did not beat the strong equity performance but that should not be a surprise given that equity exposure will only be a small portion of the total risk exposure for managers. Most managers will cap the equity exposure within the program, so even if equities are trending higher, performance will lag a long-only index.

The controlled equity exposure is one of the reasons for the low correlation between this alternative strategy and stock returns. Nevertheless, CTA’s were able to exploit the strong trend in oil as well as large moves in short-term interest rates. Fixed income opportunities were more difficult to exploit given the strong choppiness around short and intermediate moving averages.

The SocGen trend index was up 46 bps for the month and the SocGen mutual fund index showed gains of 37 bps. Their short-term index was down just over 100 bps. The BTOP50 index was down 36 bps for the month. The average mutual fund in the managed futures category for Morningstar was down 49 bps with most of the managers plus or minus 2 percent for the month.

Going into the last month of the year, managed futures index has positive year-to-date returns with better performance than commodities and bonds. However, returns trail equities which have had by any measure an unusually strong year. Allocations to this alternative strategy have done what has been expected from a diversifier to traditional asset classes.