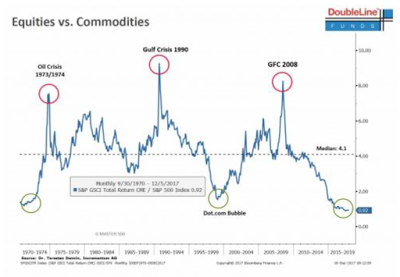

Equities are overvalued! Bonds are overvalued! In the minds of many investors everything is overvalued given central bank distortions, yet there may be an exception. Look at commodities. The difference between financial and real asset could not be larger. Financial assets have steadily moved higher while commodities have fallen or at best moved sideways relative to risky stocks in the last 5+ years. This relationship has applied to all equity indices around the world to varying degrees.

One can argue that commodities are more closely tied to current economic growth while equities are tied to valuations of long-term discounted cash flows as one explanation. Equities have positive carry while commodities as measured through futures have seen mixed carry with market contango for the last few years; however, there are now switches to backwardation in some markets. The business cycle relationship with commodities suggests that these real markets peak late in the cycle not when there is a new surge in growth. Still, on a relative performance basis, commodities as an asset class looks like a better value.

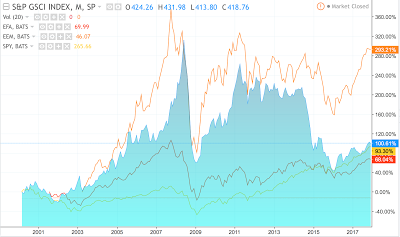

Nevertheless, there is a word of caution when we recast the data relative to global stock indices. US equities have exceeded previous highs and shown the most consistent gains since the Financial Crisis (FC). Over the long-run emerging market (EEM) equities have shown the strongest performance, albeit levels are still below highs. Global stocks (EFA) still have a ways to go before reaching prior highs. Globally, the financial to real asset story is slightly weaker.

Commodities have been more susceptible to deep declines as seen in 2008 and again in 2014 and have not moved in the same manner as equities; however, stronger global growth and better relative valuation makes this a more attractive asset class alternative for investor consideration.