Equity factor risk premium ranks change through time. The best performing factor premium today may not be the best premium tomorrow even if there are long-term gains across major factors. Most investors would agree with this statement; however, the dispersion of factor performance is more complex.

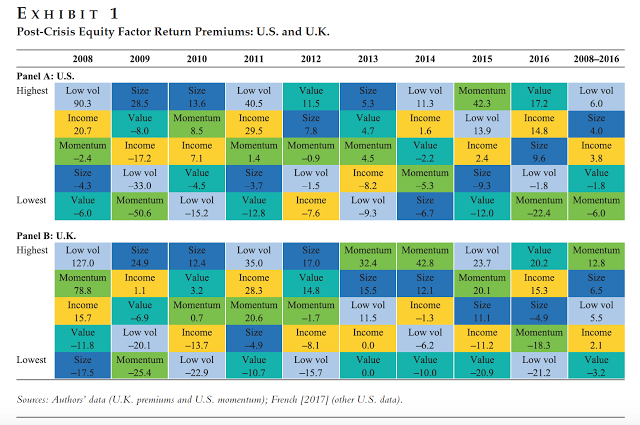

The paper “Factor-Based Investing: The Long-term Evidence” by Dimson, Marsh, and Staunton does a great job of summarizing all of the work on the key factors used for investing. It is a must read and easily accessible for any investors, but there is one table that caught my attention. This is a table of the equity factor return premiums in the US and UK across time. First, it clearly shows that the ranking change through time, but looking at the overall rankings from 2008-2016 across countries was especially interesting.

Notice that the worst performing factor in the US was momentum and the best performing factor in the UK was momentum. All of the other factors seem to have relatively similar rankings and returns. The largest return gap for a factor between the US and the UK is with momentum. The risk for momentum is with sudden stops or drops in performance which may be associated with crashes, but the US-UK gap over ten years is large.

My conjecture from this table is that risk factors have to be diversified globally and that this is especially the case for momentum. Global macro managers who diversify around the world with equity momentum and trend-following are accounting for the fact that momentum is not the same across countries. Global diversification of risk factors makes for good portfolio construction.