I would not be the first to engage in the lazy thinking that managed futures are synonymous with trend-following. There was little wrong with using both terms to mean the same thing for many years. The majority of managed futures are still trend-following.

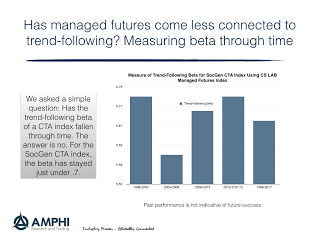

We ran a non-overlapping regression using five years of monthly data to measure the trend-following beta of the SocGen CTA index, a peer group index of managers. We used the CS Liquid Beta managed futures trend-following index as the proxy for trend-following. The numbers suggest that the beta is about the same for a widely followed peer index since 1998 at approximately .7.

However, the last year or two suggests a growing gap within the managed futures strategy space that will not be picked up within the trend-following beta of a peer group of primarily large managers.

The business strategy gap has been the growing marketing push to sell trend-following as a low-cost quant strategy. We are now seeing some leading firms market their trend-following strategy at flat fees of 50 bps. The same firms may have other futures-based strategies at higher fees, but actually market a “pure” or “stripped-down” version of trend-following as a low cost product.

This product pricing push has changed the revenue model for these firms. There may be more money coming into managed futures, but it is at lower fees; consequently, there has been a move to develop new strategies explicitly marketed as non-trend-following quant or trend-following plus.

These products have added models attached to a core strategy. Complexity has been added to either justify higher fees or differentiate product offering from the core trend product. Hence, it is becoming harder to analyze managers in this strategy space. Investors will have to implement some form of core-satellite between trend and non-trend managers to access the best managed futures alternatives.