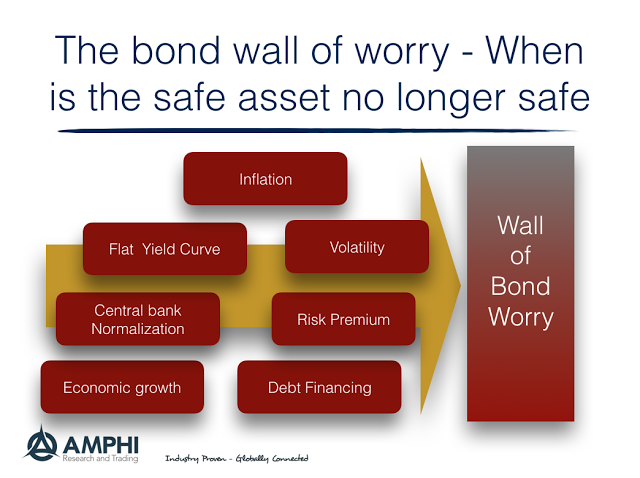

The major drumbeat of asset class overvaluation has focused on equities, but perhaps a scarier place to invest is holding long duration bonds. Both asset classes may be overvalued, but a close look at the economic fundamentals may suggest that greater concern should be with bonds.

- Economic growth is biased upward – Current forecasts for US growth are still below 3% but last two quarters have surprised the market to the upside. Announcement surprises have all been positive for the last few months. Survey data are all positive about economic growth. Generally, stronger growth translates into higher yields.

- Central bank normalization – The Fed normalization, with reduction in its balance sheet and an expected three rate increases next year, places upward pressure along the yield curve. The curbing of bond purchases by the ECB next year and Bank of China attempts to tighten credit markets places upward pressure on global rates.

- Flat yield curve – The flattening of the yield curve from Fed normalization has the added impact of reducing the carry gain from holding longer-duration bonds. The can have the effect of reducing bond demand.

- Inflation bottom headed higher – The inflation numbers may not be hitting 2% for PCE, the preferred index for the Fed, but the CPI is now at 2.2 up from a low of 1.6% mid-year. The NY Fed Underlying Inflation Gauge (UAG) is at the highest levels since the Financial Crisis.

- Debt financing strong supply – Debt financing continued in 2017 at a feverish pace as debt issuers hit the market before expected rate increases. 2018 will continue to see strong supply both from private and Treasury debt needs. The Fed will not be the buyer of last resort.

- Risk premium bottom – Bond risk premiums continue to stay at unusually low levels. Any normalization will cause rates to rise relative growth and expected inflation.

- Volatility of bonds – The MOVE bond volatility index followed the VIX and hit all-time lows in October. While volatility may stay low, the changing structural dynamics with central banks being sellers not buyers suggest that there is room for more volatility.

In a less safe bond world, cutting duration is a good start for portfolio protection, but looking for diversification through other strategies like global macro/managed futures may be a better bet.