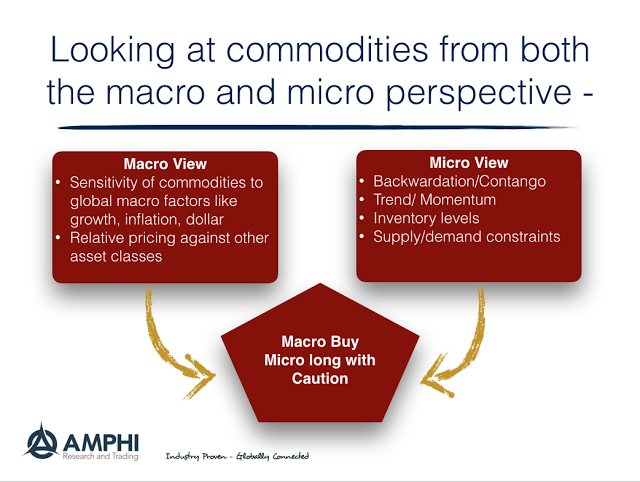

The narrative for holding an allocation to commodities by looking through a macro factor lens may generate different conclusions than taking a micro market-specific perspective. While the macro perspective is good for setting longer-term strategic allocations, the micro perspective helps with tactical decisions on where or how to put money to work in commodities.

We are commodity bullish given the following:

- Economic growth rising around the world. Expectations have also increased for 2018 and economic surprise indices are all bullish. Survey data shows economic optimism and for the US fiscal stimulus will provide a tailwind for growth.

- The dollar has increased in value for 2017 which is negative for commodities, but forecasts for a continued dollar are mixed. We are more dollar positive, but the consensus is more mixed and the dollar is still off its previous high over the last three years.

- Relative asset class value suggests that commodities are cheap relative to financial assets. The large gains in financial assets have not carried over to real assets like commodities. Housing has moved higher in many countries but commodity inputs suggest continued malaise. This relative return difference is likely to close.

- Inflation may not be hitting 2% central bank targets but the general trend and direction for expectations is tilted higher. The NY Fed Underlying Inflation Gauge (UIG) has reached the highest level since the Financial Crisis

Our views on a micro basis are also positive but more tempered:

- Trend and momentum indicators have been more mixed when looked at on a commodity-specify level although given the low correlation between commodities this is not always surprising.

- Some markets like oil have moved to backwardation which have a large effect on commodity index performance, but core agriculture markets are still in contango. We will note that commodity indices based on carry (long backwardation/short contango) had strong positive gains this year.

- Inventories have declined but still are not indicating any commodity shortages.

- CAPEX has fallen in many commodity sectors This investment decline has placed a constraint on future supply; nevertheless, this is a longer-term effect that will not affect tactical trading but will allow for tightening of the supply/production overhang.

A half way approach to commodity investing is to invest in a factor-based index instead of a volume/production weighted long-only index. Alternatively, scaling exposure into commodities is another approach for gaining access. Still, commodities are poised to offer better return potential for investors.