At the end of the year, investors will review their asset allocation decisions. Often investors will think about their pie chart exposures to different asset classes and strategies. Too often the focus is on asset class allocations and not enough on strategy differences. The problem with asset classes is that correlations may change significantly in a crisis with the usual problem being a movement to one. Diversification is not present when you need it.

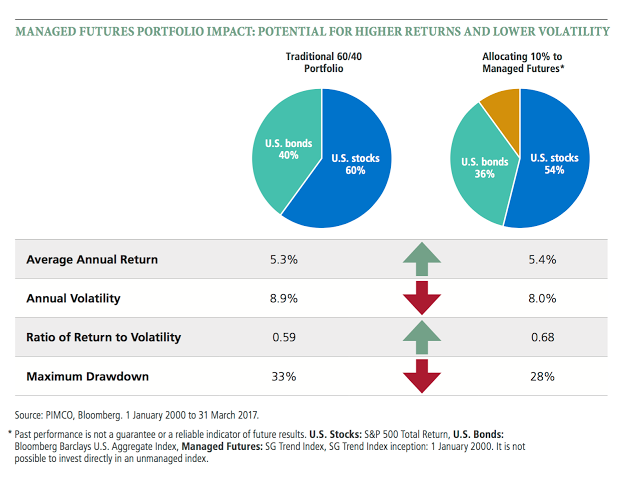

An alternative approach is to focus on strategy diversification which may not be as susceptible to correlation increases because strategies adapt and may not be wed to long-only exposure. A perfect example is managed futures which over the long-run has shown to have the characteristics of increasing return, cutting volatility, increasing the information ratio, and cutting drawdowns as seen through a simple study for close to 17 years.

Cutting the pie slightly differently through including strategy diversification may be an easy way to create value in the new year.