Many pension and endowments are going to post double-digit returns for 2017. Most have exceeded their actuarial expect return assumptions of 7%. Family offices and general investors have also posted good returns for the year.

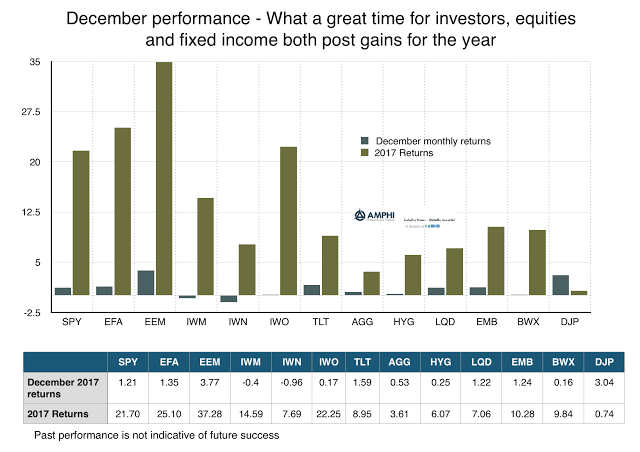

Equity returns for US, international and emerging market portfolios all generated over 20% and bond portfolios were still able to post positive returns. It was a great year with any 60/40 stock bond combination generating more than ten percent. The only asset class that did not perform well was commodities.

The frustration for many was being too conservative at the beginning of 2017 and holding alternatives for diversification. Of course, 2017 began with significant political uncertainty and growth concerns. We suggested that the market would face the bimodal risk of either secular stagnation or a growth resurgence. We got the growth resurgence, but it was a surprise for most investors.

Well, you can put 2017 in the books and you have start a new year tomorrow. We will likely be surprised again, but investors cannot bank on positive surprises as an investment strategy.

A coherent strategy will be to place emphasis on two factors – valuation and momentum. Momentum tells you to stick with the current allocation while valuation states to take money away from the most overvalued asset classes. You can stick with momentum in the short-run but a more strategic focus will think about valuation as the driver for 2018 and increase diversification across asset classes and strategies.