Much has been made about the value of managed futures during periods of market crisis, but there are also some other regularities that have been found for this strategy that can help with understanding performance.

A breakdown of the investment environment between risk-on and risk-off periods will find that managed futures does better when the environment is classified as risk-off and does less well when the environment is risk-on. There are a number of indicators which can help define these periods including volatility, credit spreads, and direction of certain asset classes. In a risk-on world, equities will do well as investors will demand lower premiums and hold more risky assets. In this environment, it does not pay to diversify or to manage position exposure to volatility. 2017 turned into a risk-on environment that did not play to the strengths of active management of risk.

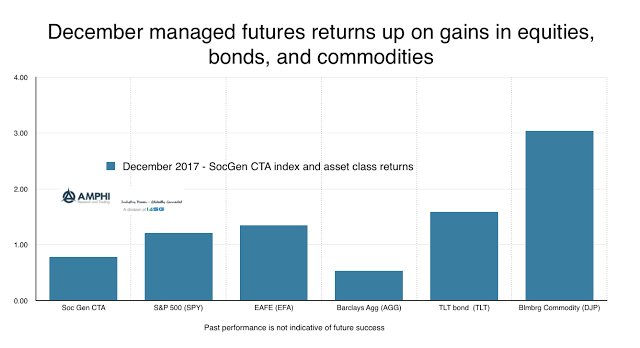

Managed futures generated gains of approximately 2.5% for the SocGen CTA index in 2017. The returns for managers who either had a short-term focus, a long-term low turnover emphasis, or some multi-model strategy did better than this average. Focused intermediate-term trend managers generally fell below the index average, as diversification and active position management were not rewarded. Holding a diversified basket of selective strategies did allow for better upside.