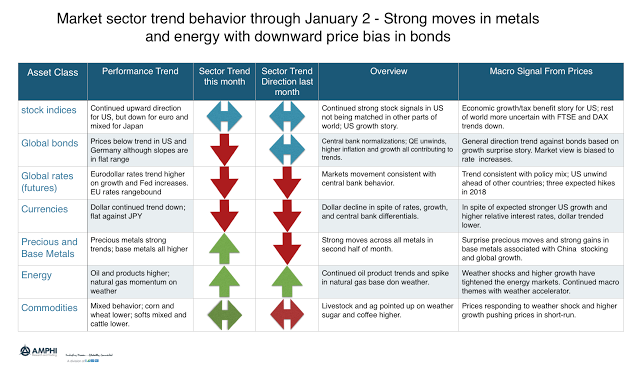

There were some trend surprises in markets near the end of the year; the upward price movement in both precious and base metals and the weather shock in the natural gas market and to a lesser extent oil product markets. The question for the beginning of the year is whether these trends will only be short-term in nature. Strong price spikes, especially weather related, are often reversed.

Both base and precious metal sectors were up across the board and have moved through short-term, intermediate, and longer-term trend signals. While base metal trends have been building on the economic growth story, the gold and precious moves were somewhat unexpected even with the talk of higher inflation.

Bond prices have been moving lower across most global markets based on the combination of higher economic growth, higher expected inflation, and expectations of central bank policy normalizations and unwinds. Equity trends have been mixed. The US equity markets continued to trend higher, but European stock indices have moved in the opposite direction. Japan equity prices are above our trend measures but the overall slopes for these trends are flat.

We have added a column to our trend table which shows the asset class trend direction from previous month to allow investor a quick visual on trend changes over the month. At this time, early indications suggest that there will be profitable trend opportunities for January.